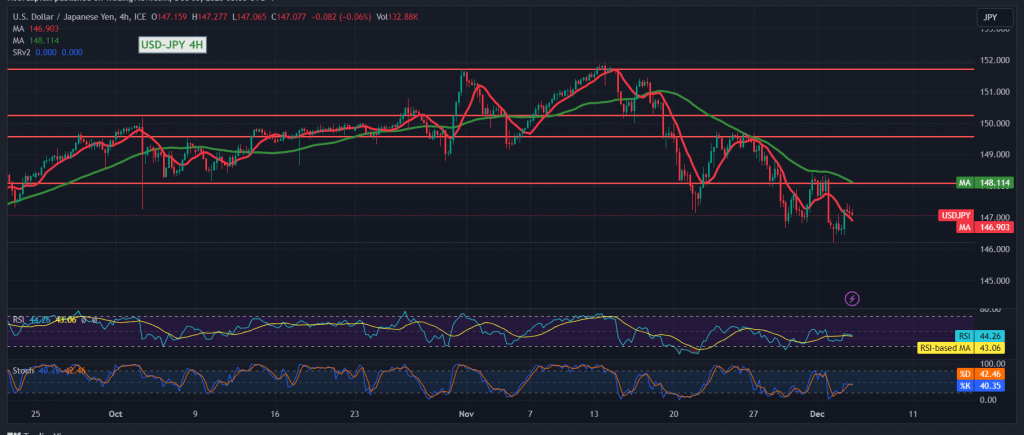

The dollar/yen pair initiated a decline at the beginning of the current week’s trading, aligning with the anticipated bearish scenario outlined in the previous report. This downturn followed the identification of a robust resistance level around 147.50.

From a technical perspective, a bearish outlook is favored, contingent upon sustained trading below the resistance levels of 147.45, and particularly 147.60. The pair is experiencing negative pressure from the simple moving averages, supporting the overall bearish trajectory in daily prices.

The potential for a continued downward trend remains valid, with a target set at 146.40. It is crucial to monitor whether the pair manages to break and consolidate below this level, as it would strengthen the bearish momentum, with the next target at 145.70.

It’s important to note that consolidation of prices above 147.60, confirmed by the closing of at least an hour candle, may prompt the pair to attempt an upward trend with an initial target of 148.15.

Warning: The risk level may be high.

Warning: High-impact economic data is expected today from the American economy, including the ISM Services Purchasing Managers’ Index, job vacancies, and the labor turnover rate. Expect potential high price volatility during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations