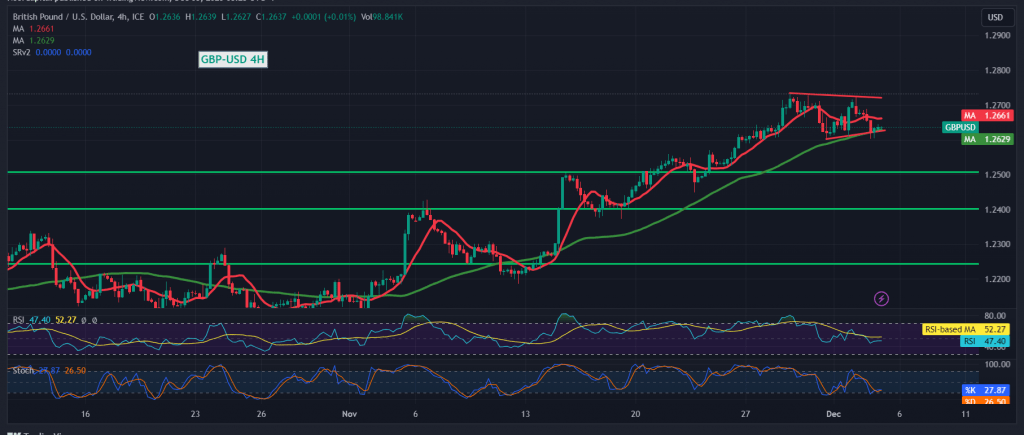

The British pound faced challenges in sustaining itself above the psychological barrier resistance of 1.2700, leading to significant downward pressure that prompted a retest of 1.2600.

From a technical standpoint today, the simple moving average is attempting to support an upward movement, converging around the 1.2585 support level, reinforcing its significance. On the flip side, the Stochastic indicator is gradually losing its upward momentum.

Given conflicting technical signals, it is advisable to closely monitor the pair’s price behavior for potential scenarios:

- Downward Trend: To confirm a downward trend, we need to observe the price consolidating below 1.2585. This would place the pair under negative pressure with initial targets at 1.2535, potentially extending towards 1.2500.

- Uptrend: Confirmation of a breach above 1.2710 is essential for the resumption of the uptrend, allowing it to regain control over the pair’s movements. Initial targets for the uptrend start at 1.2780.

Warning: High-impact economic data from the American economy is expected today, including the ISM Services Purchasing Managers’ Index, job vacancies, and the labor turnover rate. Be prepared for potential high price volatility during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations