The British pound exhibited a trading session that leaned towards negativity but managed to conclude transactions above the support level identified at $1.3630.

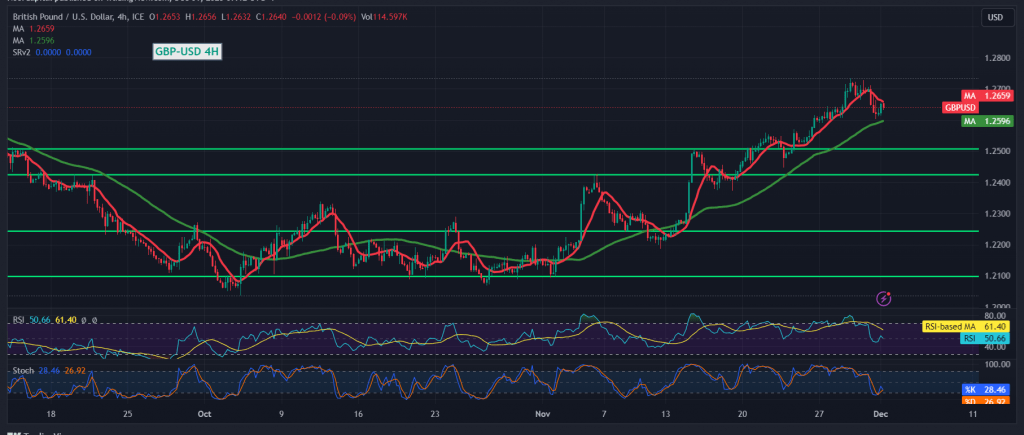

From a technical perspective today, a positive outlook is favored, contingent on stability in trading above $1.2590. This positivity is further supported by the Stochastic indicator’s attempts to gather additional momentum, potentially driving the price higher.

The target is set at $1.2700, and surpassing this level would serve as a motivating factor, increasing the likelihood of reaching $1.2760 as the subsequent target. Further goals may extend to $1.2805 unless trading falls below $1.2590. Such a scenario could thwart upward attempts, causing the pair to shift towards $1.2545 initially.

Warning: High-impact economic data is anticipated from the American economy today, including the Manufacturing Purchasing Managers’ Index issued by the ISM and a press talk by the Chairman of the Federal Reserve. Consequently, there may be high price volatility at the time of news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations