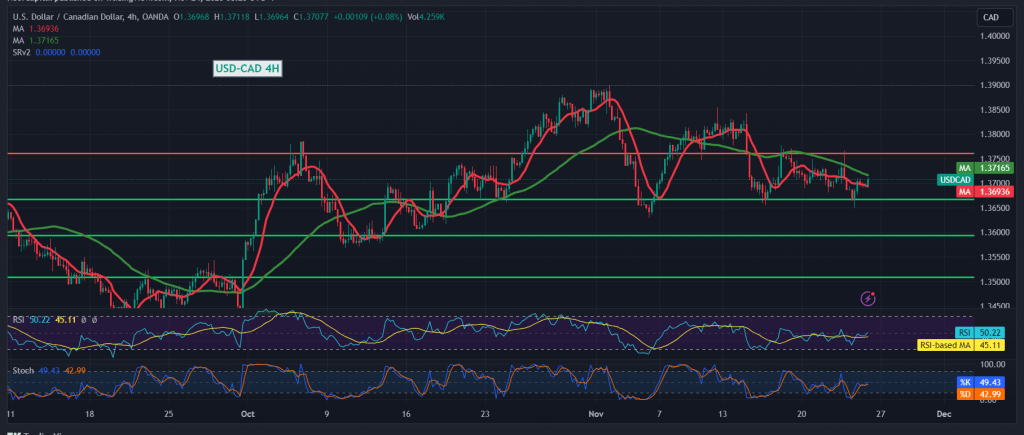

The Canadian dollar remains within a narrow-range side trading pattern, restricted from the bottom by the support level of 1.3680 and from the top by the resistance level of 1.3730.

Analyzing the technical aspects on the 4-hour time frame chart, the 50-day simple moving average serves as an obstacle for the pair, suggesting the potential for a decline. However, positive signs are emerging on the 14-day momentum indicator.

Given these conflicting technical signals, it’s advisable to monitor the price behavior for potential scenarios:

- A breach below the strong support at 1.3680 may pave the way for a visit to 1.3650, the initial target, followed by 1.3600 as the next official station.

- Price consolidation above the resistance level of 1.3740 could act as a motivating factor, increasing the likelihood of an upward trend. The initial target for an upward move would be 1.3790.

Warning: Today’s market activity may be influenced by high-impact economic data from the Eurozone, the press talk by the President of the European Central Bank, and updates from the American economy. The release of the “preliminary reading of the services and manufacturing purchasing managers’ index” may induce high price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations