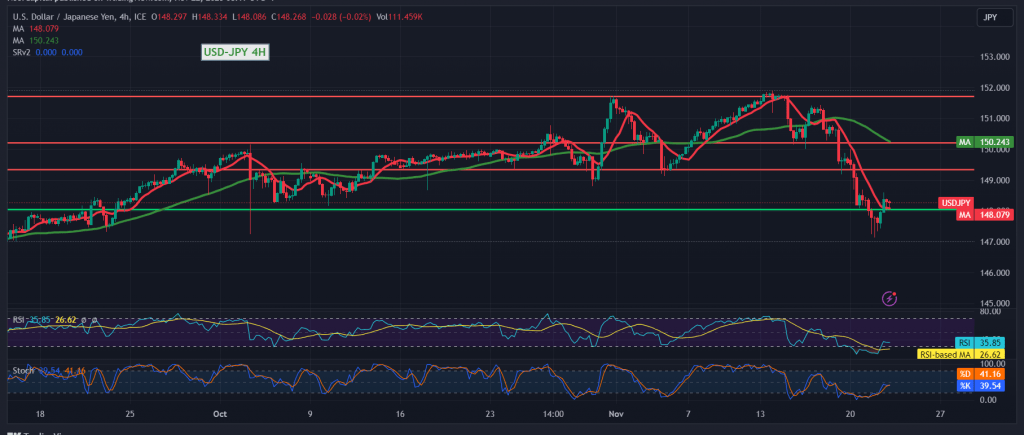

The USD/JPY pair experienced an unexpected reversal in the previously anticipated downward trend, contrary to the analysis in the prior technical report. Despite the initial reliance on trading stability below the resistance level of 148.60 at the time of the report, the pair exhibited a temporary upward tendency, reaching its highest level at 149.75. Consequently, the entire sell position was replaced.

Upon closer examination of the 4-hour chart, it becomes evident that the Stochastic indicator has entered overbought areas, coupled with a continued movement below the 50-day simple moving average. Despite this temporary upward movement, opportunities for a renewed downward trend remain, targeting a retest of the previously breached resistance now turned support level at 148.20/148.30. A break below this level would likely resume the downward trend, with initial targets around 147.30.

Conversely, from the upper end, a return to trading stability at 149.90 would completely invalidate the proposed scenario, signaling a resumption of the upward trend with an initial target of 150.70.

Note: Today, we await highly impactful economic data from the Eurozone, including the preliminary readings of the services and manufacturing PMI index from France and Germany. Additionally, from the United Kingdom, we anticipate the preliminary reading of the services and manufacturing PMI index. These releases may induce high price fluctuations during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations