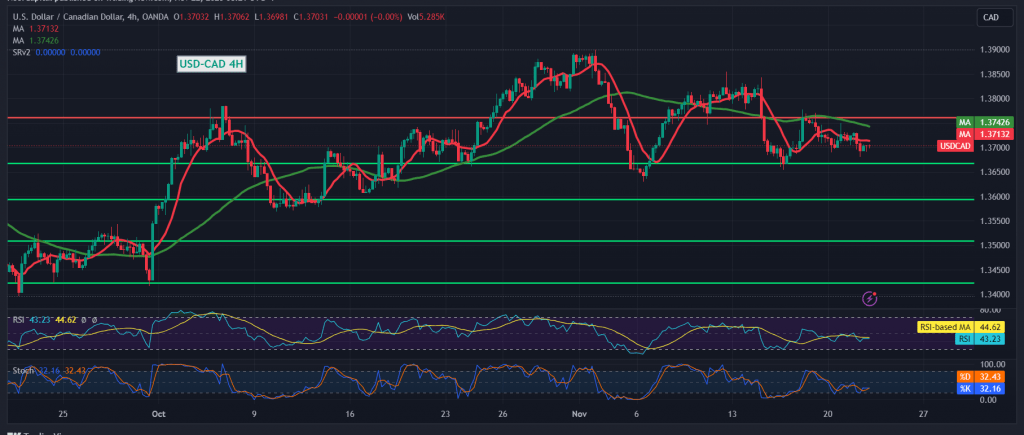

The technical situation for the pair remains unchanged, with no significant shifts over the past three sessions. The pair continues to exhibit negative stability after encountering a robust resistance level around 1.3770.

From a technical standpoint today, examining the 4-hour time frame chart reveals the formation of a resistance level around 1.3770 by the simple moving average, adding strength to it. Additionally, the 14-day momentum indicator shows clear negative signals.

There is a possibility of a bearish trend during today’s trading session, targeting a retest of the main support at current levels (1.3680). Monitoring the pair’s behavior around this level is crucial, as a break may lead to losses extending towards 1.3630.

On the upside, if the price consolidates above 1.3770, it could prompt the pair to recover and complete its upward movement towards 1.3800 and 1.3830. Further gains may extend to visit 1.3870.

A cautionary note: High-impact economic data is expected from the American economy today, including the revised reading of the Consumer Confidence Index from the University of Michigan and a press talk by the Governor of the Bank of Canada. This may result in increased price fluctuation.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations