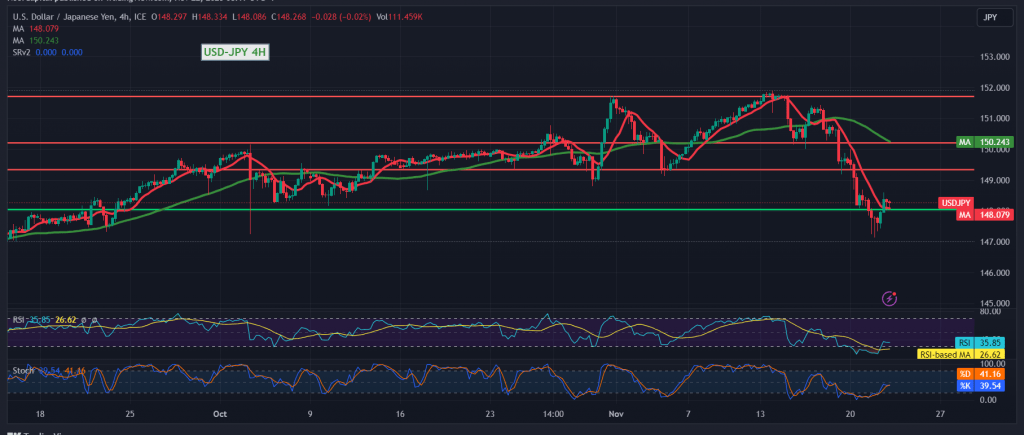

The USD/JPY pair experienced limited positive movements during the previous trading session, reaching the 148.60 resistance level without being able to breach it.

From a technical perspective today, there’s a tendency to revert to the downside, based on the stability of intraday trading below the 148.60 resistance level. The Stochastic indicator, gradually losing upward momentum, adds to the negative outlook.

This suggests maintaining a bearish outlook, with a target set at 147.40, and a potential break below that level could facilitate further decline towards 146.55.

In case the pair regains stability above 148.60, it might delay the bearish scenario but won’t eliminate it. In such a scenario, a temporary bearish trend might occur, with the goal of retesting 149.20 and 149.45.

A word of caution: High-impact economic data is expected from the American economy today, particularly the revised reading of the Consumer Confidence Index from the University of Michigan, along with a press talk by the Governor of the Bank of Canada. This may lead to increased price fluctuation.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations