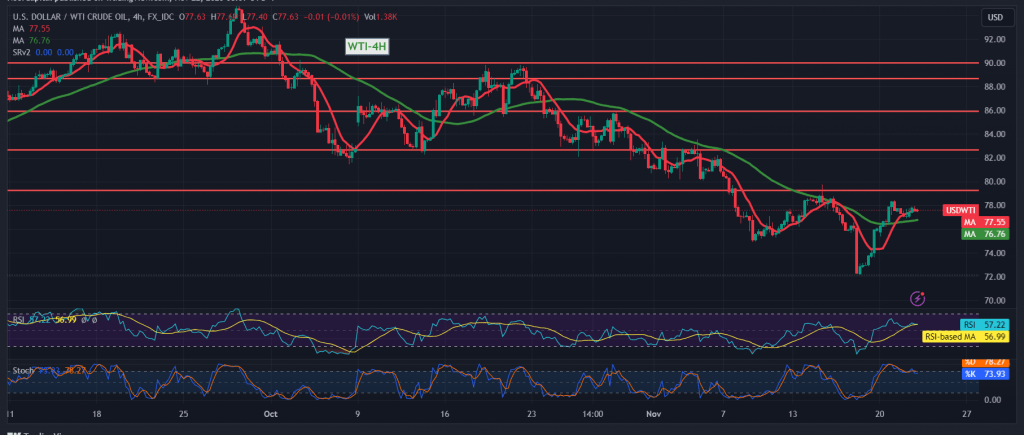

US crude oil futures prices experienced narrow-range side trading without significant changes, with movements confined between 77.00 at the bottom and 77.90 at the top.

From a technical perspective, there is a leaning towards negativity, albeit with caution. This inclination is based on the evident negative crossover signals observed on the Stochastic indicator, which has started to lose its upward momentum. Additionally, intraday trading remains stable below the psychological barrier resistance level of 78.00.

The upcoming hours may witness a bearish tendency. It’s noteworthy that breaching below 77.00 could pave the way for a visit to 76.50 initially. It’s crucial to closely monitor any upward movement that consolidates above 78.00, as it would immediately halt the bearish trend, allowing oil prices to recover with targets starting at 78.40 and extending towards 78.90.

A word of caution: Today, high-impact economic data is expected from the American economy, specifically the revised reading of the Consumer Confidence Index from the University of Michigan, along with a press talk by the Governor of the Bank of Canada. This may result in heightened price fluctuation. Moreover, the overall risk may be elevated amid continuing geopolitical tensions, potentially leading to increased price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations