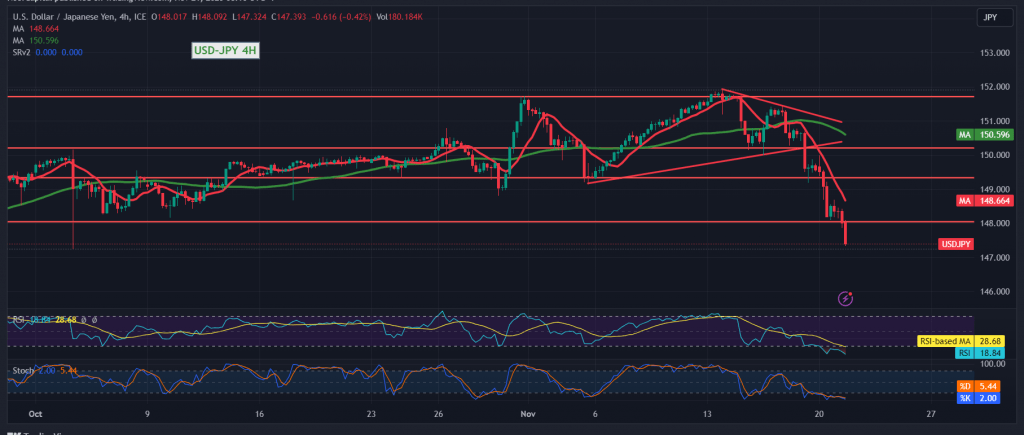

The USD/JPY pair exhibited a substantial decline within the anticipated downward corrective trend, achieving the forecasted targets during yesterday’s trading, reaching a price of 148.20 and recording its lowest level during the morning session of today at 147.33.

From a technical standpoint, the confirmation of the pair breaking below the support level of 148.00, now acting as a resistance level due to the concept of role reversal, coupled with the ongoing negative pressure from the simple moving averages, supports the maintenance of negative expectations. The next target is set at 146.50, and a breach below it is anticipated to pave the way for a further decline towards 145.60.

On the upside, the return of trading stability around 148.20 might temporarily postpone the likelihood of a decline, but it does not negate the possibility. A temporary bearish trend may unfold, aiming for a retest of 149.20 before potentially resuming the downward trajectory.

A note of caution: Today, high-impact economic data is expected from the American economy, particularly the results of the Federal Reserve Committee meeting and the press talk of the President of the European Central Bank. Additionally, the release of the consumer price index from Canada may result in heightened price volatility. Traders should exercise caution and remain alert to market developments.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations