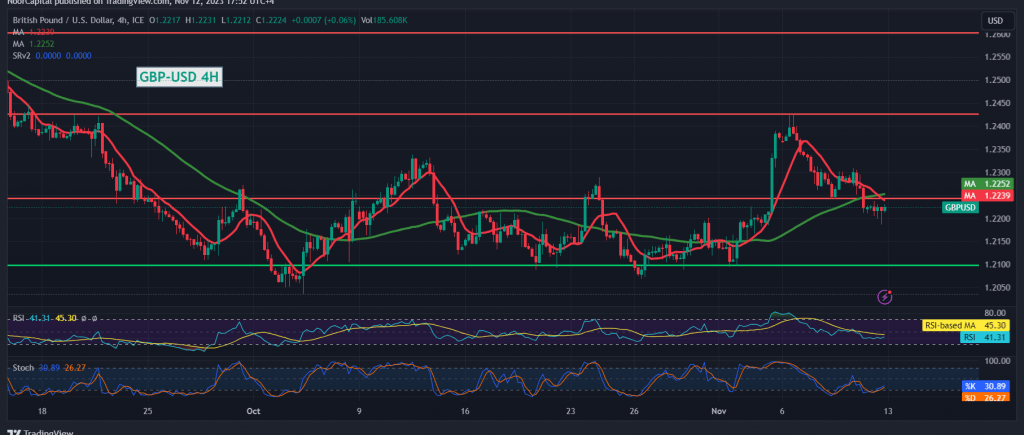

The British pound experienced a significant decline against the US dollar, aligning with our anticipated negative technical outlook. The pair came close to the official target of 1.2170, reaching its lowest point at 1.2187.

Upon closer examination of the 240-minute time frame chart, it is evident that the pair remains generally stable below the psychological barrier resistance level of 1.2300. This signifies a sustained negative stance, supported by the pair’s position below the 50-day simple moving average.

Consequently, the potential for a downward bias is affirmed, with the initial target set at 1.2170. A breach of this level would intensify and expedite the downward trend, paving the way towards 1.2120. However, a consolidation above 1.2300 could act as a motivating factor, capable of disrupting the bearish scenario. In such a case, the pair might recover, targeting 1.2340 and then 1.2375, with potential gains extending towards 1.2420.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations