In the previous technical report, we maintained an intraday neutral stance for the US crude oil futures contract due to conflicting technical signals.

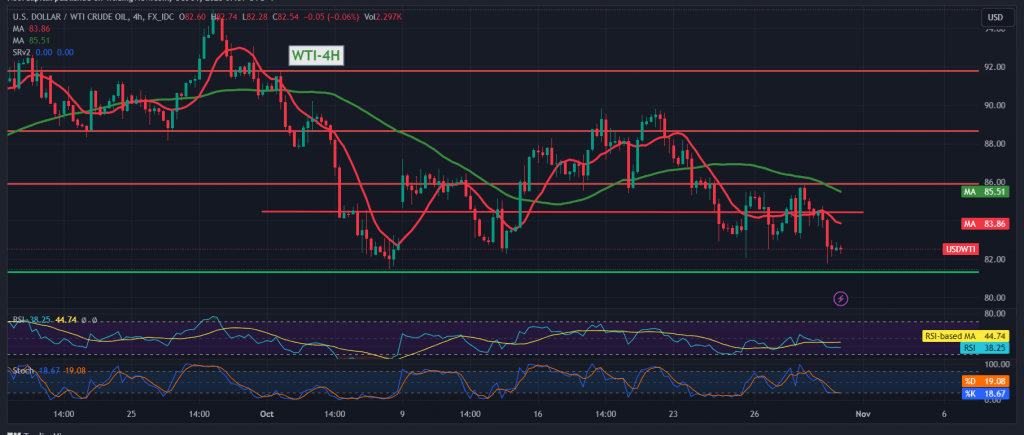

The price movements indicated a downward trend, highlighting the necessity of a clear and robust breach of the 83.80 level to activate selling positions. The target after such a break would be 82.95, with the possibility of reaching its lowest point at $81.86 per barrel.

Analyzing the 240-minute time frame chart confirms the breach of the strong support floor at 84.50. Continued negative pressure from the simple moving averages supports the ongoing downward trend.

Consequently, the bearish scenario remains the most favorable, with the initial target set at 81.15. It’s crucial to note that breaking this target level could further extend oil losses, paving the way directly towards 78.85, the subsequent support level.

On the contrary, a break above and price consolidation beyond 84.50 would invalidate the proposed scenario. In this scenario, the oil price could rebound, aiming for 85.50 as the next target. Careful monitoring of these key levels is essential for understanding the future trajectory of oil prices.

Please take note that today, the market is awaiting significant economic data from both the US, including the Consumer Confidence Index, and Canada, particularly the monthly gross domestic product. There might be substantial price fluctuations when these news releases occur.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations