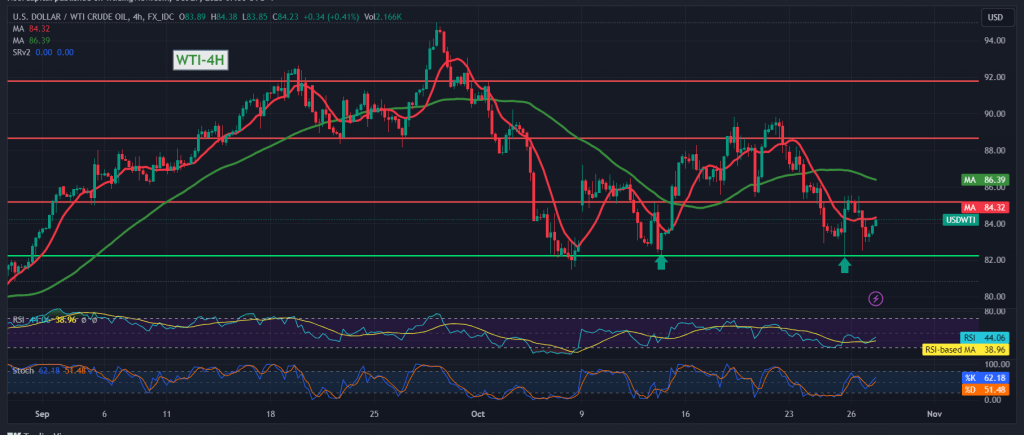

During the previous trading session, Mixed trading dominated US crude oil futures. The price recorded its lowest level around $82.70 per barrel after an attempt to consolidate above $85.35.

Technically, when we look closer at the 240-minute time frame chart, we notice the 50-day simple moving average trying to push the price higher, accompanied by attempts by the 14-day momentum indicator to gain more upward momentum.

We tend to be positive during the coming hours, but cautiously and with two targets: 85.10/85.00. Breaching the first target may enhance the chances of a rise to 85.65. We must pay close attention to this level because breaching it may motivate a reduction in losses, and the price may head towards 86.45.

Only from below, the return of trading stability below 83.10 will immediately stop the attempts to rise and lead oil prices to resume the downward trend, with targets starting at 82.00 and 81.20.

Note: Today we are awaiting high-impact economic data in the US, the Core Personal Consumer Expenditure Price Index and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations