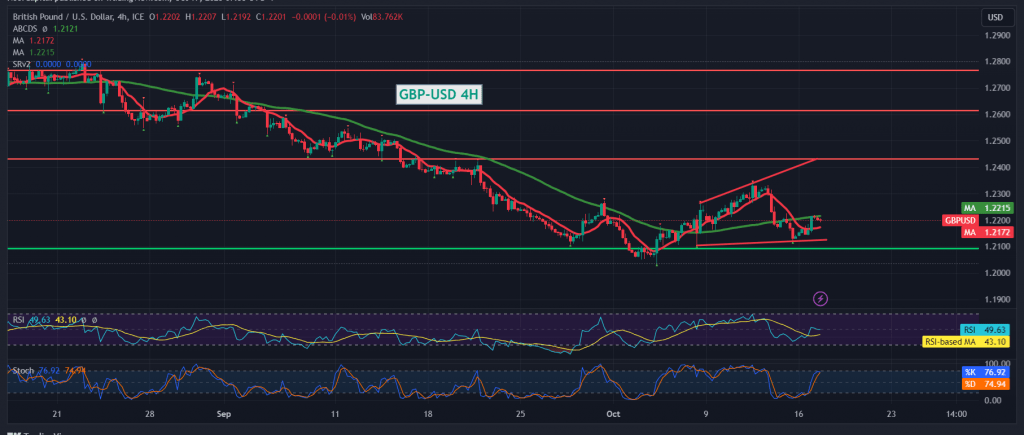

Positive trades dominated the movements of the pound sterling against the US dollar, building on solid support floor at the price of 1.2140 within an upward rebound to retest the resistance level of the psychological barrier 1.2200.

On the technical side, we indicated in the previous report that a break up and the price consolidation above 1.2220 is a condition for an upward trend. We find that intraday trading is stable below 1.2220 with continued negative pressure from the 50-day simple moving average and the Stochastic indicator of upward momentum loss.

We are leaning towards negativity, targeting 1.2150 as the first target, considering that sneaking below the mentioned level puts the pair under negative pressure, with its next target being around 1.2100.

Only from above is the return of trading stability again above the strong resistance at the price of 1.2220, which invalidates the activation of the proposed bearish scenario and the pair returns to the upward trend with targets starting at 1.2270 and 1.2290.

Note: Today, we are awaiting high-impact economic data in the US, retail sales index and the annual core consumer price index from Canada, and we may witness high volatility at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations