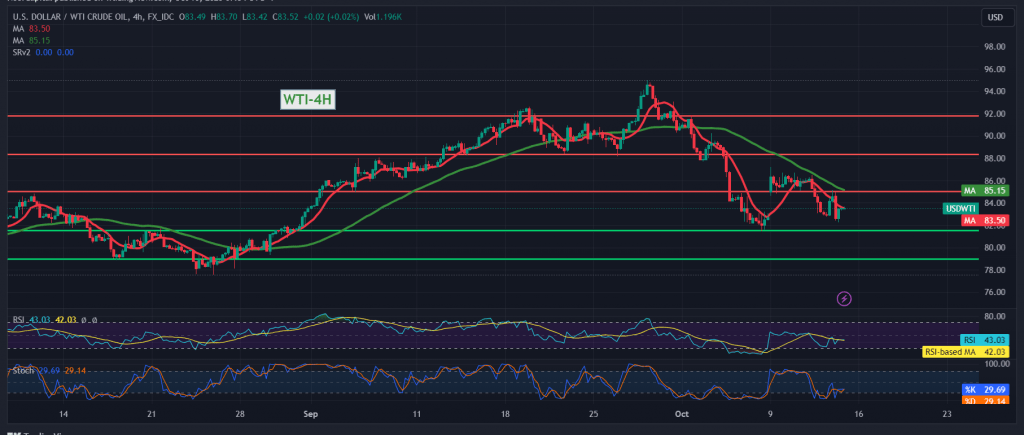

The movements of US crude oil futures witnessed negative trading within the expected bearish context after it failed to stabilize for a long time according to the psychological barrier resistance of 85.00, recording its lowest level at $82.35 per barrel.

The daily trend is still bearish, with continued negative pressure on the simple moving averages and clear negative signals on the Relative Strength Index on short time intervals.

From here, with daily trading remaining below the resistance level of 85.10, which meets near the 50-day simple moving average, the bearish scenario remains valid and effective, targeting 82.20 as the first target, and breaking it increases and accelerates the strength of the downward trend, as we wait to touch 81.50, an awaited official station.

Consolidation above 85.10 will immediately stop the downward trend and lead oil prices to recover, with targets starting at 86.40.

Note: Today we are awaiting high-impact economic data issued by the US, “Preliminary Consumer Confidence Reading – Michigan,” and from the UK, we are awaiting a speech by the president of the Bank of England, and we may witness high fluctuation in prices at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations