During the beginning of the previous trading session, gold prices were able to touch the first target required to be achieved in the last report at 1884, recording its highest level of $1885 per ounce, to return within a bearish tendency, affected by the rise of the US dollar after US inflation data that came positive.

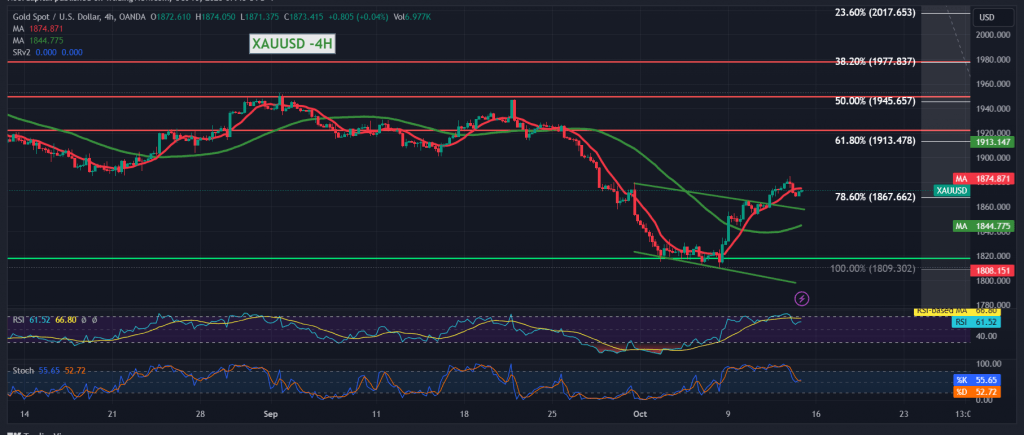

Technically, the 1867 support level succeeded in limiting the downward tendency, and the intraday movements are witnessing stability above the mentioned level. We find the 50-day simple moving average still holding the price from below, which is stimulated by the Stochastic indicator’s attempts to eliminate the current negativity.

Therefore, the possibility of the return of the upward trend is still present and effective as long as intraday trading remains above 1865, and in general with daily trading remaining above 1867, targeting 1885 as a first target, and breaching it enhances the chances of touching 1893 and 1909, respectively. The gains may later extend towards 1913, the 61.80% Fibonacci retracement.

We remind you that the price sneaking below 1857 with a radiant close for at least an hour postpones the chances of a rise and puts the price under temporary negative pressure, whose goal is to retest 1847 and 1838 before the rise begins again.

Note: The risk level is high.

Note: Today we are awaiting high-impact economic data issued by the US, “Preliminary Consumer Confidence Reading – Michigan,” and from the UK, we are awaiting a speech by the president of the Bank of England, and we may witness high fluctuation in prices at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations