Limited positive attempts dominated the movements of the Euro/Dollar pair at the end of last week’s trading, with several consecutive sessions of decline. As we explained during the previous technical report, the price’s consolidation above the psychological barrier resistance of 1.0600 is a condition for an upward correction.

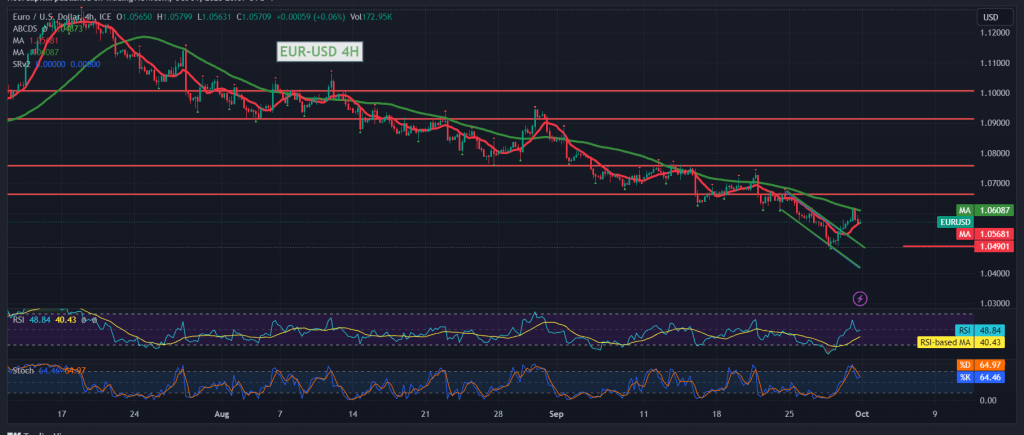

Technically, the pair failed to consolidate above the resistance of the psychological barrier of 1.0600. With a closer look at the 4-hour chart, we find that the 50-day simple moving average still constitutes an obstacle to the pair, supporting the resumption of the downward wave. On the other hand, the Stochastic indicator is trying to eliminate negativity. The intraday increases the possibility of a continuation attempt to make the upward correction referred to in the previous report.

With conflicting technical signals, we prefer to monitor price behavior to activate the following pending orders:

The price consolidates again above 1.0600, with a target of 1.0630. Then 1.0685 as the next station, considering that going above and consolidating the price above 1.0685 is the key to extending the bullish correction as we wait for 1.0750.

To get a downward trend, we need to witness consolidation below 1.0600, targeting 1.0500 as the first target, and sneaking below it constitutes a negative pressure factor for us to wait for 1.0435.

Note: Today we are awaiting high-impact economic data issued by the US economy, the Manufacturing Purchasing Managers’ Index, and the speech of Federal Reserve Chairman Jerome Powell, and we may witness high price fluctuations at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations