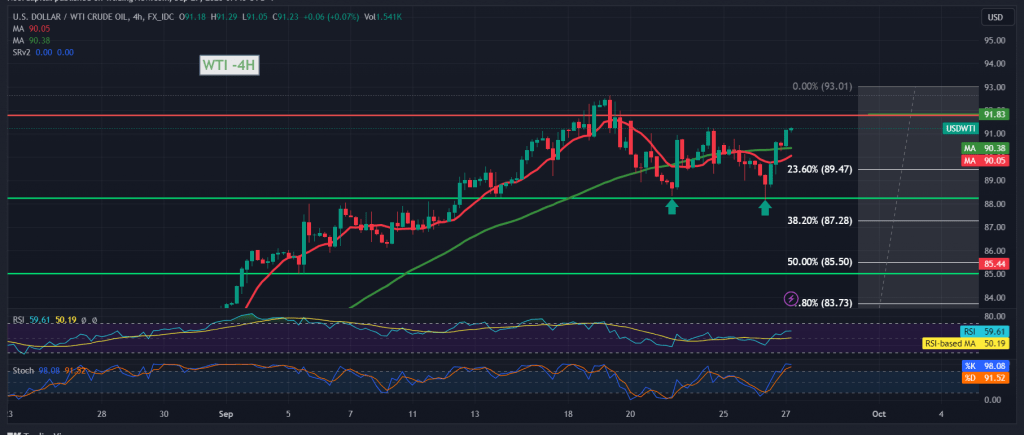

US crude oil futures prices achieved the idea of a corrective decline published during the previous report, touching the first bearish correction target of 88.65, approaching a few points ahead of the second target of 88.00, recording its lowest level at $88.23.

Technically, prices witnessed a rapid upward rebound due to the price approaching the support floor of the psychological barrier of 88.00 after it completed the downward correction. The current movements witnessed stability around its highest level during early trading of the current session 91.30, explaining that the price’s consolidation above 90.40 is a motivating factor that may enhance the chances of touching 91.40.

The simple moving averages returned to hold the price from below and support the possibility of a rise, accompanied by clear positive signals on the 14-day momentum indicator and trading stability above 90.40.

We may witness an upward bias during today’s session, provided that we witness consolidation and stability of the price above 91.40, which opens the door to visit 92.30, the first target, and then 93.30.

Sneaking below 90.40 leads oil prices to complete the downward corrective path, with targets starting at 89.25 and extending towards 87.20.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations