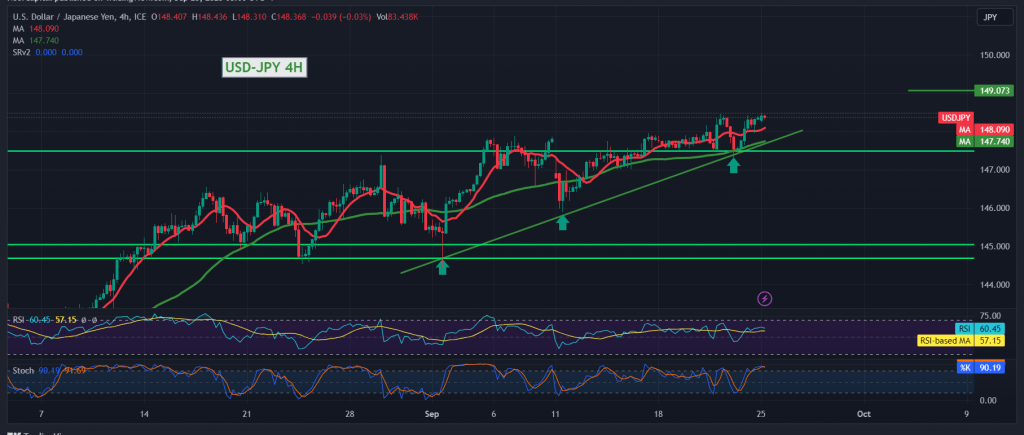

The USD/JPY pair continues to achieve upward targets, reaching the first target required during the previous technical report at 148.50, recording its highest level of 148.49.

On the technical side today, the 50-day simple moving average still supports the upward curve of prices, and this comes in conjunction with the positive 14-day Momentum indicator signals.

From here, with daily trading remaining above 147.60, the bullish scenario remains valid and effective, targeting 148.70, knowing that breaching it is a motivating factor that leads the pair to complete the upward path with targets starting at 149.00.

We remind you that sneaking below 147.60 postpones the chances of a rise but does not cancel them, and we may witness a bearish tendency aimed at retesting 147.00 and 146.70 before attempts to rise again.

Note: We may witness some price fluctuation as the Stochastic indicator attempts to eliminate the current negativity.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations