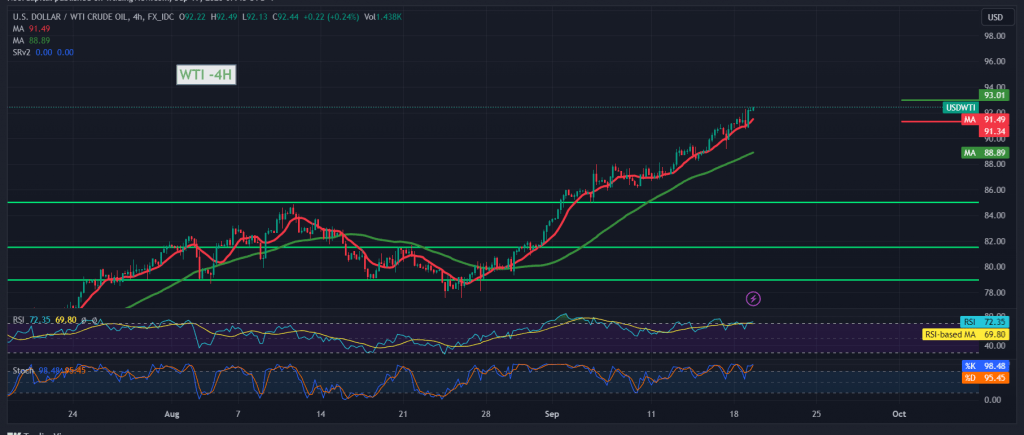

US crude oil futures prices rose within the expected positive outlook, achieving gains towards the first expected target of 92.20, recording its highest level of $92.50 per barrel.

Technically, we tend to be positive in our trading, relying on the price continuing to receive a positive stimulus from the simple moving averages that continue to hold the price from below, supported by the continuation of clear positive momentum signals on the 14-day momentum indicator.

From here, with daily trading remaining above 91.30, the bullish scenario remains valid and effective, targeting 93.00 as the first target, taking into account that price consolidation above the level above is a motivating factor that enhances the chances of a rise, as we await 93.60 and 94.40 as next stations.

From below, closing the hourly candle below 91.30 postpones the proposed bullish scenario, and we may witness a simple bearish correction aimed at retesting 90.20 before attempts to rise again.

Note: Risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations