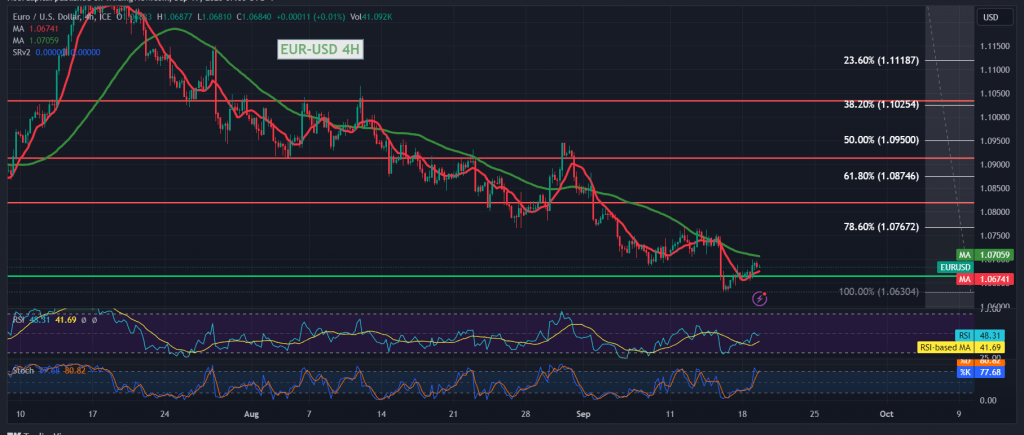

Quiet trading dominated the movements of the EUR/USD pair at the beginning of this week’s trading as it attempted to breach the psychological barrier resistance level of 1.0700.

On the technical side today, the 50-day simple moving average still represents an obstacle to achieving further rise, and the 50-day average meets around the 1.0700 resistance and adds more strength to it, in addition to the continuation of clear negative crossover signs on the Stochastic indicator.

From here, with the stability of trading below the 1.0690 resistance level, the previously broken support that was converted into a resistance level, the downward trend remains the most preferable, targeting 1.0630 and 1.0600 as next official stations. We must pay close attention to the fact that breaking the support of the psychological barrier 1.0600 extends the pair’s losses as we wait for 1.0550, an expected official target.

Price consolidation above 1.0700 with at least an hour of candle closing can postpone the proposed bearish scenario and lead the pair to recover temporarily with the aim of retesting 1.0750.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations