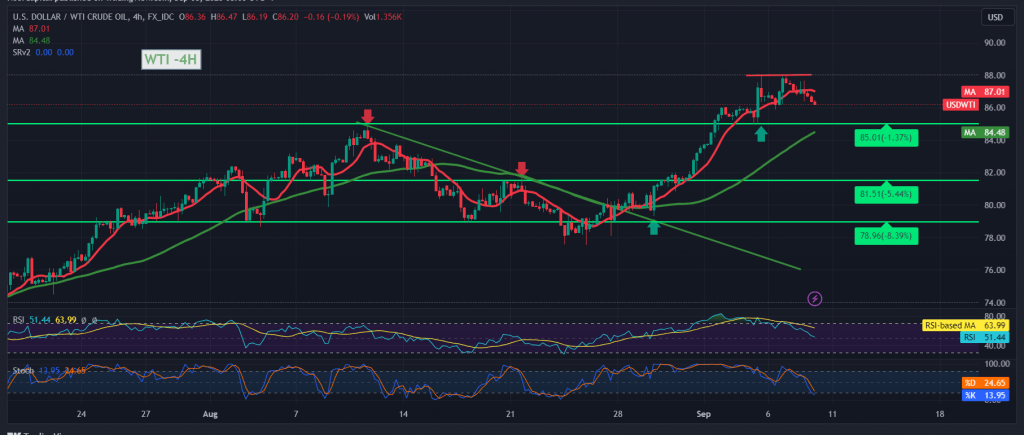

US crude oil futures prices witnessed a negative trading session within the expected bearish path within the idea of the required retest, touching the target of retesting support at 86.20, recording its lowest level during early trading in today’s session at 86.24.

Technically, by looking at the 4-hour chart, we find signs of negativity still evident on the Stochastic indicator, continuing to gradually lose upward momentum, in addition to clear negative signals on the Relative Strength Index on short time frames.

We expect the retest to be completed in the coming hours to visit 85.80 as the first target, considering that sneaking below the mentioned level extends losses towards 85.20/85.30 before attempts to rise again.

The bearish tendency does not contradict the general upward trend, whose targets are around 88.20 and 88.65 once the breach of 87.20 is confirmed.

Note: Risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations