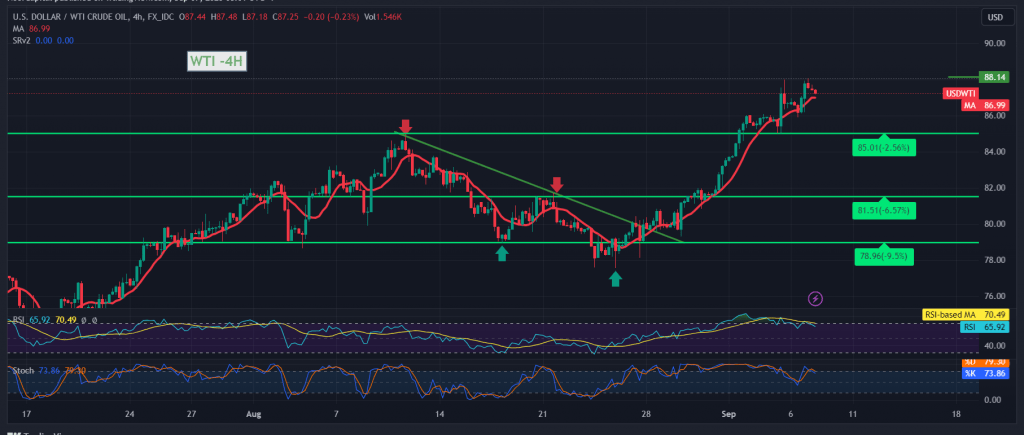

For the second session in a row, US crude oil futures prices found a strong resistance level around 88.00, which formed a negative pressure factor on the oil price to conclude yesterday’s trading around $87.55 per barrel.

Technically, the simple moving averages do not support the daily upward curve of prices and are stimulated by the stability of intraday trading above 86.15 and generally above 86.00. On the other hand, we find that the Stochastic indicator has reached overbought areas.

We believe that there is a possibility of a bearish bias occurring during the coming hours, aiming to retest 86.20 before attempts to rise again, knowing that the bearish bias does not contradict the upward trend, whose targets are located around 89.20 and 89.90 initially, once the breach of the 88.00 peak is confirmed.

We remind you that sneaking below 86.00 may lead the price to retest 85.00 before determining the next price destination.

Note: Today we are awaiting the report issued by the International Energy Agency regarding oil stocks, and we may witness high price fluctuation when the report is issued.

Note: Risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations