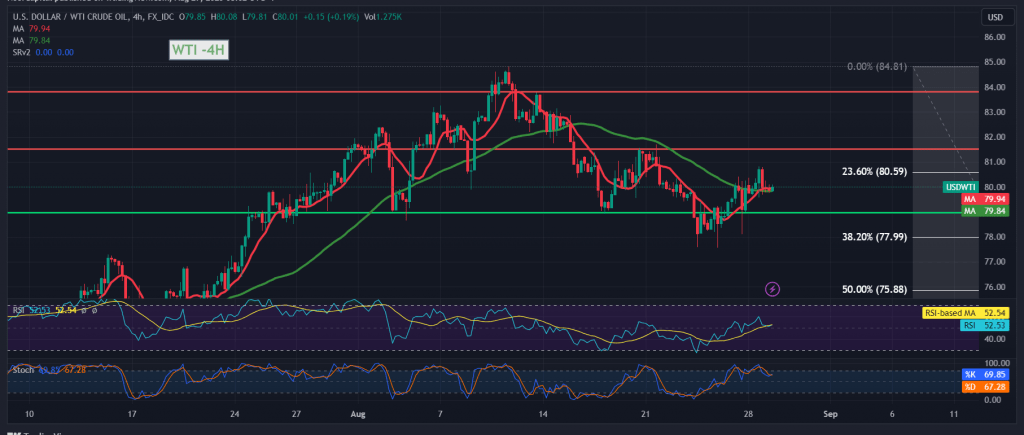

Limited positive attempts dominated the movements of US crude oil futures prices, failing to breach the main resistance of the current trading level at 80.60.

Technically, by looking closely at the 240-minute chart, we notice clear negative signs on the stochastic indicator, which is gradually losing bullish momentum and trading stability below the mentioned resistance of 80.60, represented by 23.60% Fibonacci correction.

We tend to be negative, but with caution, relying on trading remaining below the pivotal resistance 80.60/80.50, targeting 79.50, and breaking it would extend the losses, opening the door towards 79.00, the next station, noting that the price’s decline below 79.00 increases and accelerates the strength of the awaited bearish correction, to be waiting for 78.40.

The price’s consolidation above 80.70 can thwart the bearish trend and lead oil prices to recover to retest 81.30 & 81.70 before starting the decline again.

Note: the risk level may be high.

Note: Today we are awaiting high-impact economic data issued by the US economy, “Composite Home Prices” and “Consumer Confidence.”

“Vacancies and labor turnover” and we may witness a high price fluctuation at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations