The technical outlook remains unchanged, as the Canadian dollar maintains the expected bullish path during the previous report, touching our first target of 1.3575, recording its highest level at 1.3600.

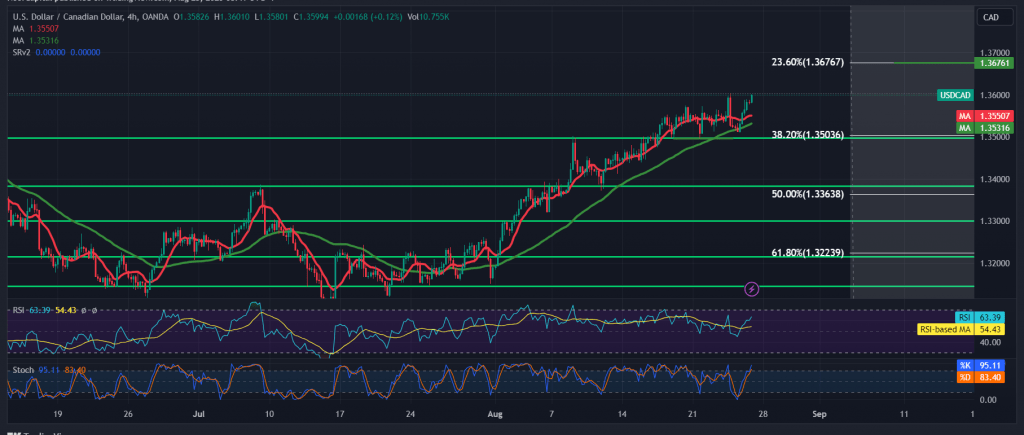

Technically, by looking at the 4-hour chart, we find that the pair is still stable above 1.3540, and in general, above 1.3500, the support represented by 38.20% Fibonacci correction.

We tend to continue the rise, provided that we witness a clear and strong breach of the resistance of the psychological barrier 1.3600, which facilitates the task required to visit 1.3640, and the gains may extend later towards 1.3670.

The confirmation of breaking the support floor at 1.3540 postpones the chances of a rise but does not cancel it, and we are witnessing a retest of 1.3500 before attempting to rise again.

Note: Today, we are awaiting economic data from “The Jackson Hole Economic Forum”, “Speech by Lagarde, President of the European Central Bank” and “American Consumer Confidence from the University of Michigan”, and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations