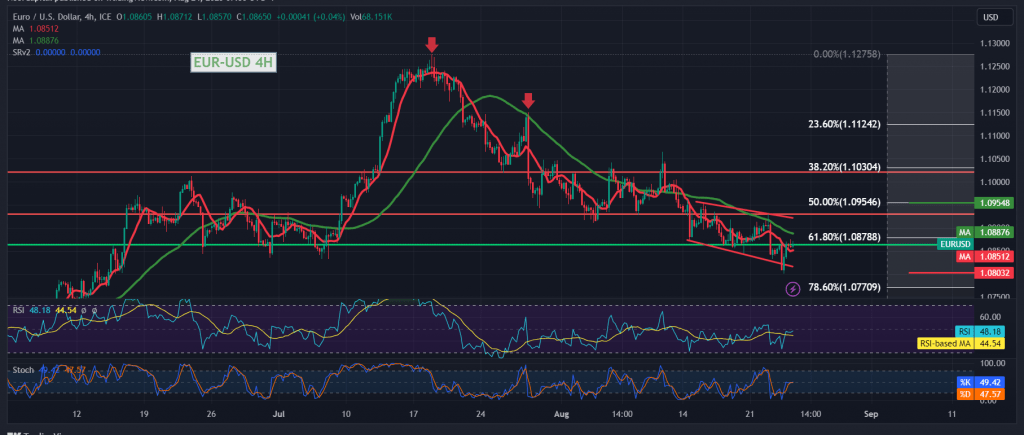

The euro-dollar pair touched the second bearish target during the previous trading session, 1.0800, recording its lowest level at 1.0802.

On the technical side, the pair’s movements witnessed an upward rebound as a result of touching the support of the psychological barrier represented by the target 1.0800, to return positively, approaching the retest of the 1.0885 resistance level, by looking at the 4-hour chart, we find the pair stable below the previously broken support, which was converted to the resistance level of 1.0885 Fibonacci correction. 61.80%, and the 50-day simple moving average is still an obstacle to the pair, in addition to the stochastic reaching the overbought threshold.

From here, with the stability of intraday trading below the resistance above 1.0885, and in general below 1.0955 50.0% correction, the activation of the bearish trend remains valid and effective, targeting 1.0800, and breaking it will lead the pair directly towards 1.0775 and 1.0720 later.

We remind you that consolidating the price above 1.0955 will immediately stop the bearish trend and lead the euro to form an upward attack targeting 1.1000 and 1.1030, respectively.

Note: Today we are awaiting economic data from the summit of the “BRICS”, and “Jackson Hole Economic Forum”, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations