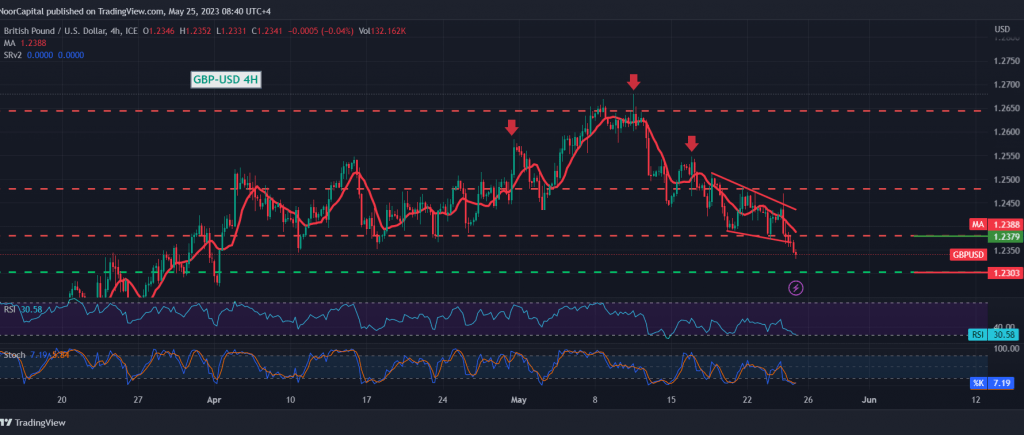

As we expected, an acceleration in the downside direction dominated the movements of the British pound against the US dollar. As a result, we touched our first desired target at 1.2340, recording its lowest level during the morning trading of today’s session at 1.2333.

On the technical side, by looking at the 240-minute chart, we find that the negative pressure from the simple moving averages is still valid, in addition to the negative signs coming from the 14-day momentum indicator, which is stable below the 50-center line.

With the stability of daily trading below the previously broken support that turned into a resistance level at 1.2380, the bearish scenario remains the most likely, targeting 1.2290 as the first target, and then 1.2245 as a next station.

Only from above trading stability will return above 1.2380, and an hourly candle closes above it, which postpones chances of a downside move, and we may witness a retest of 1.2430, before determining the next price direction.

Note: Today, we are awaiting high-impact economic data issued by the US economy, “the preliminary reading of the Gross Domestic Product,” quarterly, and we may witness a high fluctuation in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations