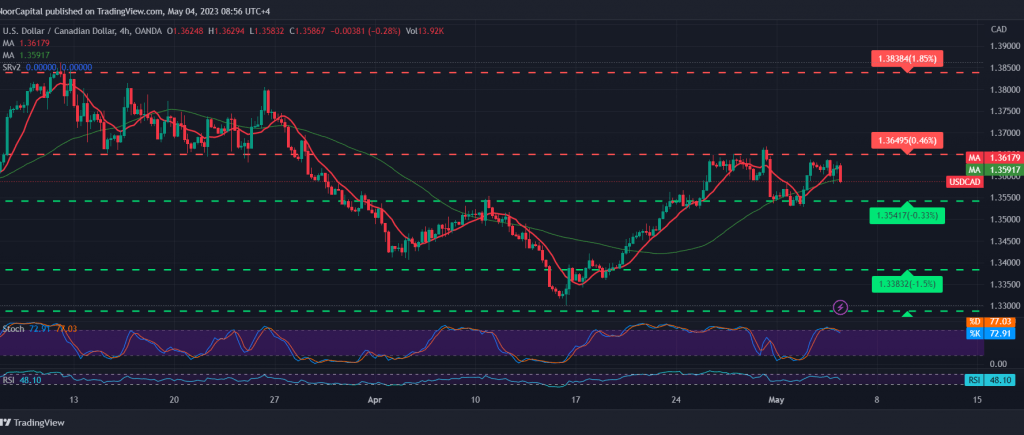

Positive trades dominated the movements of the Canadian dollar during the previous trading session after it succeeded in breaching the resistance level of 1.3585, which is hovering around at the moment and starts with negative pressure on the mentioned level.

Technically, and when looking closely at the chart, we find that the simple moving averages started to put negative pressure on the price from above, accompanied by the clear negative signs on the stochastic indicator, which gradually lost bullish momentum.

The trend tends to be bullish, but we may witness some bearish inclination, which aims to retest 1.3550 and 1.3510 before resuming the bullish path again, and it should be noted that the bearish bias does not contradict the bullish trend, whose initial targets are located around 1.3660, on its gains.

Note: Today, we are awaiting high-impact data issued by the euro area, “interest rates, the European Central Bank monetary policy statement and the European Central Bank’s press conference,” we may witness high price volatility at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations