Trading tended to be positive, dominating the movements of the euro-dollar pair during the previous trading session as part of attempts to stabilize above the resistance level of 1.1000.

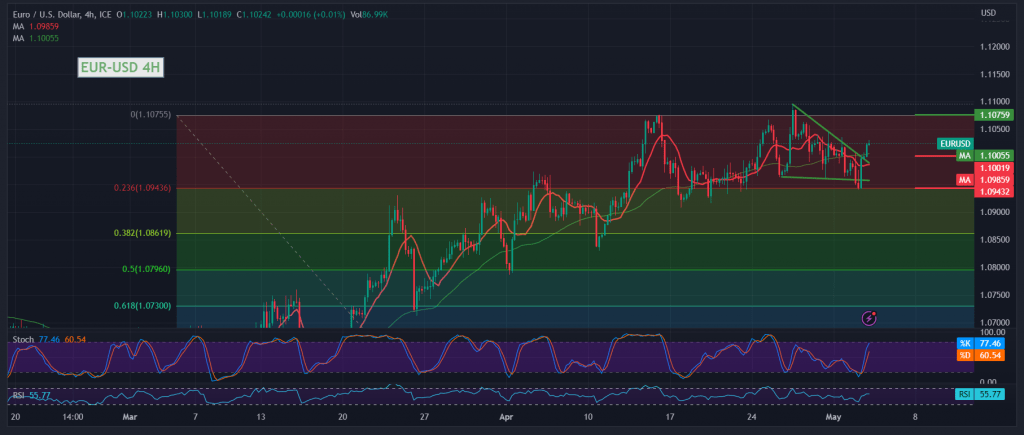

On the technical side today, the pair’s intraday movements are witnessing attempts to stabilize above the breached resistance level at the psychological barrier of 1.1000, which turned into a support level, as we find the simple moving averages returned to hold the price from below to enhance the possibility of resuming the upward trend.

Therefore, the bullish bias is more likely during the day, targeting 1.1055 as the first target, knowing that confirming the breach of the mentioned level is capable of consolidating gains towards 1.1085 and 1.1140 for the next expected stations.

The decline below 1.1000 and closing an hourly candlestick below it will stop the suggested scenario, and we will witness a retest of 1.0945, represented by 23.6% Fibonacci correction.

Note: Today, we are awaiting high-impact economic data by the US, “change in private sector jobs, services PMI, interest rate, Federal Reserve Committee statement and Federal Reserve press conference”, and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations