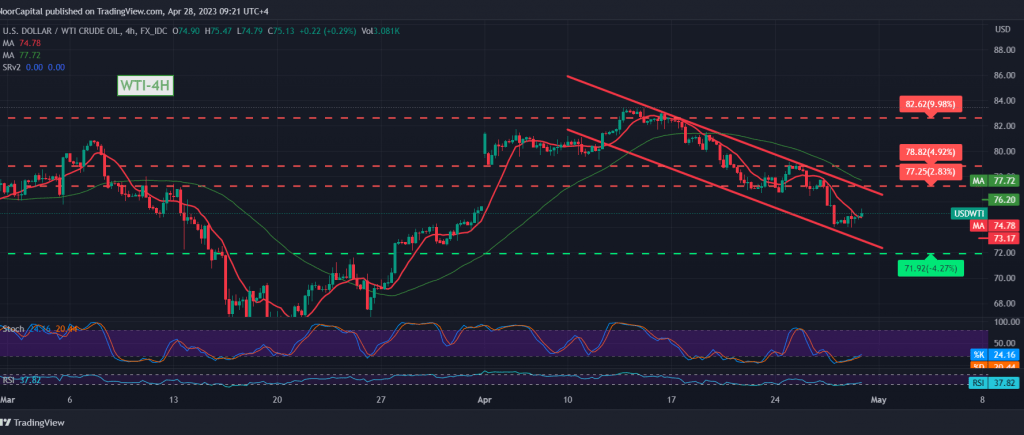

Mixed trading tended to be positive, dominating the movements of the US crude oil futures contracts during the previous trading session, trying to take advantage of the support base for the psychological barrier of 74.00 within limited attempts to achieve some bullish rebound.

Technically, the simple moving averages continue to exert negative pressure on the price from above, and we notice that stochastic started to lose its positive momentum on the 240-minute time frame.

With the continuation of daily trading stability below the previously broken support, which turned into the resistance level of 76.10, the bearish scenario remains the most likely during the day, targeting 74.35 as a first target, and breaking it increases and accelerates the strength of the bearish daily trend, continuing towards the rest of the previous analysis targets 73.50 and 73.00 initially, noting that the official target is located. around 71.70.

Trading stability above the resistance level of 76.30 can thwart the suggested scenario and lead the price to recover temporarily towards 76.80 & 77.10.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations