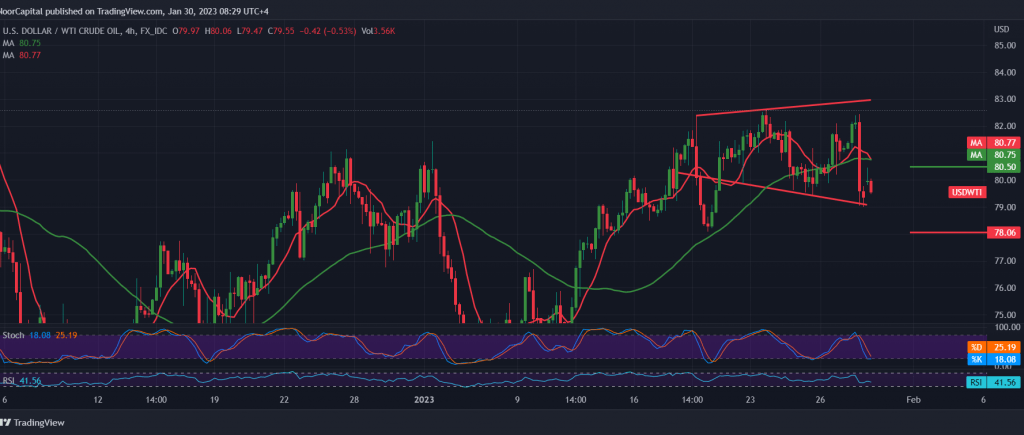

US crude oil futures prices were able to touch the first bullish target at 82.30, recording its highest level at the end of last week’s trading at 82.45, which formed a strong resistance level that forced oil to trade significantly to be able to break the support floor of 80.20, explaining that this puts the price under negative pressure with the goal of 79.00, recording the lowest at 79.08.

Technically, by looking at the 4-hour chart, we find that oil is stable below 80.00, accompanied by the negative pressure of the simple moving averages, which returned pressure on the price from above, which comes in conjunction with the clear negative signs on the RSI.

Therefore, the bearish bias is the most likely during today’s session, provided that the breach of 79.00 is confirmed and that increases and accelerates the strength of the bearish bias, targeting 78.25 as the first target, and the losses may extend to 77.00.

Rising above 80.20, and most importantly 80.60, delays the chances of a decline, and we are witnessing a retest of 81.60 before the start of the decline again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations