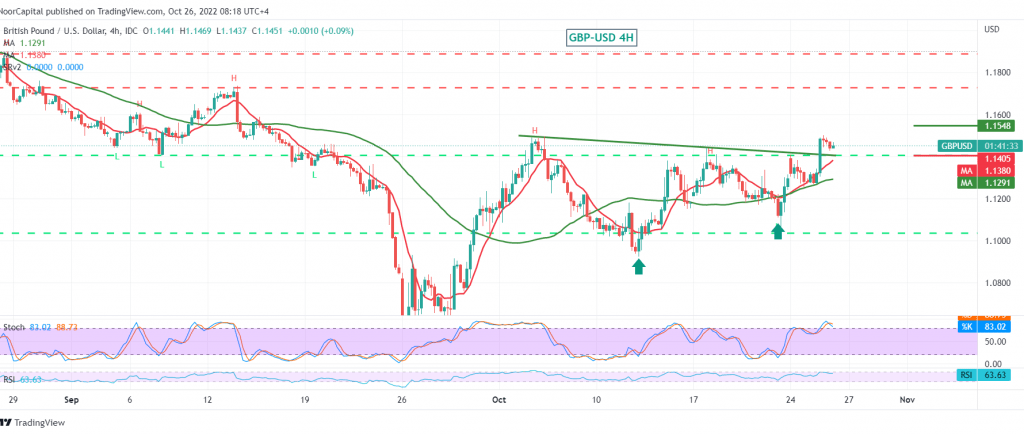

The British pound continues its gradual ascent to the upside against the US dollar to retest the psychological resistance level of 1.1500 during the last trading session.

On the technical side today, and with a careful look at the 4-hour chart, we find the pair continues to get positive motive from the simple moving averages, accompanied by clear positive signs on the RSI on the 60-minute time frame.

The bullish bias is most likely during the day, with trading remaining above 1.1410. We need to witness a clear and strong breach of the 1.1500 resistance level to enhance the chances of a rise towards 1.1545, a first target, and gains may extend later to visit 1.1590 as long as the price is stable above 1.1410.

The stability of trading below 1.1410 renews the chances of returning the bearish context towards 1.1320 before attempts to rise again, knowing that the bullish bias is still valid and effective, with trading generally stabilizing above 1.1180 in relation to the general trend on the intraday term.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.1320 | R1: 1.1545 |

| S2: 1.1180 | R2: 1.1640 |

| S3: 1.1090 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations