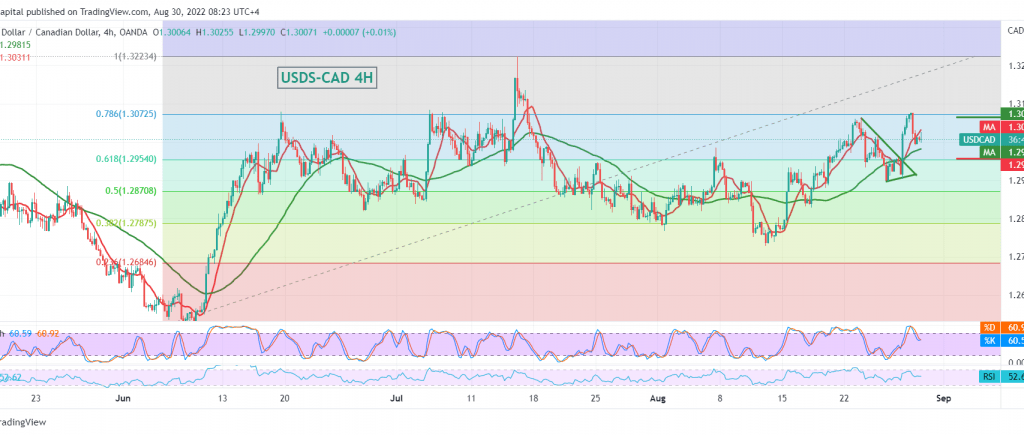

Positive trades witnessed the movements of the Canadian dollar, maintaining positive stability, benefiting from a base on the solid support floor located at 1.2950.

Technically and carefully considering the 4-hour chart, we find the pair confirmed the breach of the 1.12960 resistance level, which has now turned into the 61.80% correction support level, accompanied by the continuation of the positive motive for the 50-day simple moving average.

Therefore, continuing the upward is still valid, targeting 1.3060, a first target, and then 1.3110, considering that rising above 1.3125 is a catalyst that enhances the chances of rising, so we are waiting for 1.3150.

Trading stability returns below 1.2960, leading the pair directly towards retesting the pivotal support floor of 1.2860 before rising again.

Note: The US “Consumer Confidence” index is scheduled to be released later in today’s session and it has an important impact and we may witness price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations