US crude oil futures prices managed to achieve the awaited bullish target at 95.70, to record its highest level during the last session’s trading at 95.67.

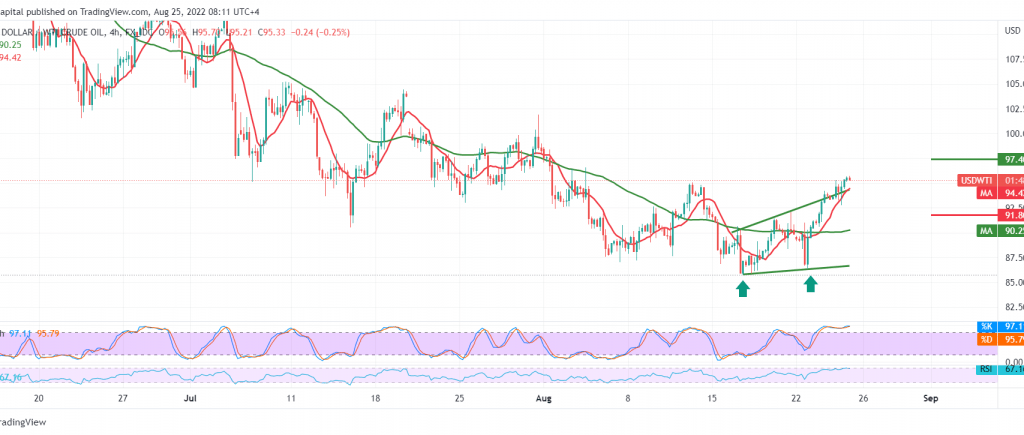

Technically and carefully considering the chart, we find the simple moving averages still support the possibility of a rise, and we find the RSI stable above the mid-line 50.

Therefore, with the price settling above 93.50, the bullish scenario remains valid and effective, targeting 96.40 first target, taking into consideration that a breaching upwards of the mentioned level leads oil prices to achieve additional gains that may extend towards 97.40 as long as the price is intraday stable above 93.50.

We remind you that the intrusion below 93.50 postpones the chances of rising but does not cancel it, and we may witness a trading session that tends to be negative, to retest 92.70 and then 91.75.

Note: the level of risk may be high.

Note: The Jackson Hole Economic Forum is taking place today, it has a significant impact on the markets, and we may see random moves.

Note: The preliminary reading of the US quarterly GDP is due, and price volatility may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations