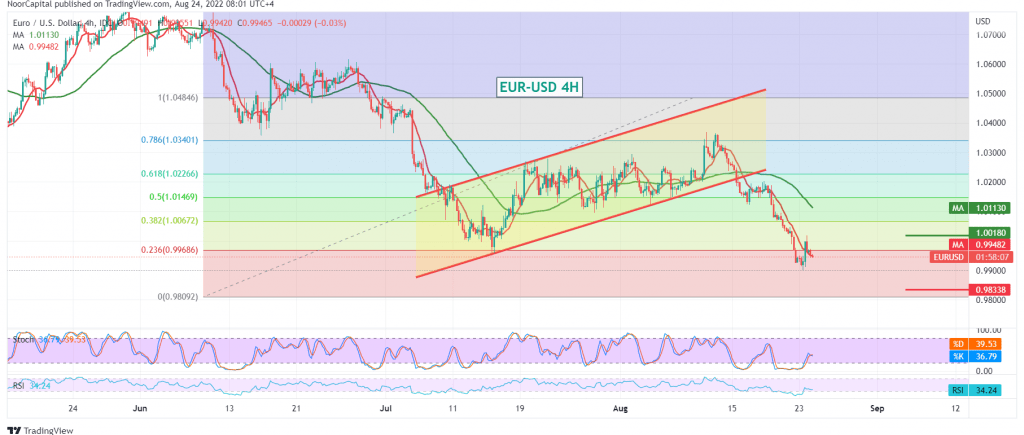

The EUR/USD pair found a strong resistance level at 1.0015, that mentioned in the previous analysis, explaining that it represents one of the most important keys to the current bearish trend, which forced it to trade negatively again.

Technically, the pair is currently hovering around the 0.9945 level, accompanied by the continuation of the negative pressure coming from the 50-day SMA, in addition to the clear negative signs on the stochastic on the 4-hour time frame.

We believe that the daily trend is still bearish, and the descending wave may extend to visit the first target 0.9890, considering that the breach of the mentioned level constitutes a strong negative pressure and increases the strength of the bearish trend opening the door toward 0.9835. Therefore, the negative targets may extend towards 0.9775 initially.

The upside move and the price consolidation above 1.0015 will postpone the suggested scenario, and the pair may witness a limited upward bias, to retest 1.0080.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9890 | R1: 1.0015 |

| S2: 0.9835 | R2: 1.0080 |

| S3: 0.9775 | R3: 1.0140 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations