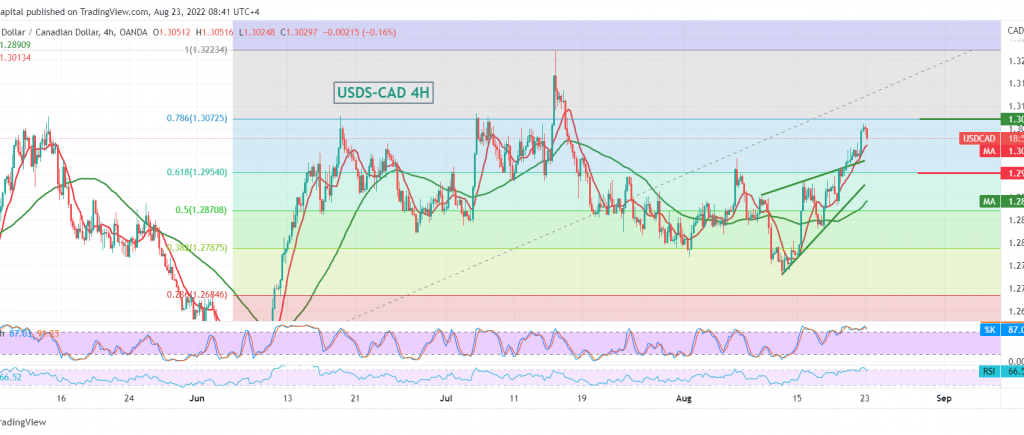

The Canadian dollar touched the first mentioned ascending target during the previous session, at 1.3050, recording its highest level at 1.3060.

Technically, the pair hit the strong resistance level represented by the target of 1.3050 to witness the current movements a bearish slope accompanied by the clear negative signs on the stochastic indicator.

We may witness a bearish slope in the coming hours, targeting a retest of 1.2980 and then a 1.2950 Fibonacci correction of 61.80%, as shown on the chart, before attempts to rise again, knowing that the bearish slope does not contradict the daily bullish trend, which targets around 1.3110 once the breach of 1.3070 is confirmed.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations