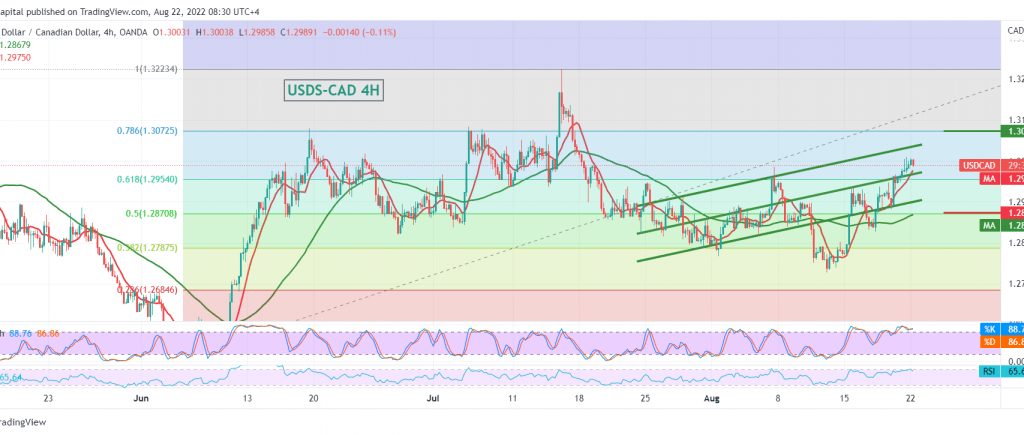

The Canadian dollar succeeded in achieving noticeable increases during the last trading sessions of last week, within the expected positive outlook, touching our first target of 1.2960 and heading to visit the second target of 1.3000, recording the highest level at 1.3010.

Technically, the pair established a support floor around 1.2950, accompanied by the positive motive of the simple moving averages that returned to hold the price from below.

Resuming the rise is the most likely scenario today. Still, we only need to confirm the breach of 1.3020, which extends the pair’s gains, opening the door to visit 1.3050 and 1.3090, respectively, knowing that stability above 1.2950 is an important and basic condition to continue the rise. In general, we continue to suggest the bullish trend as long as the trading is Stable above 1.2870, 50.0% correction.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations