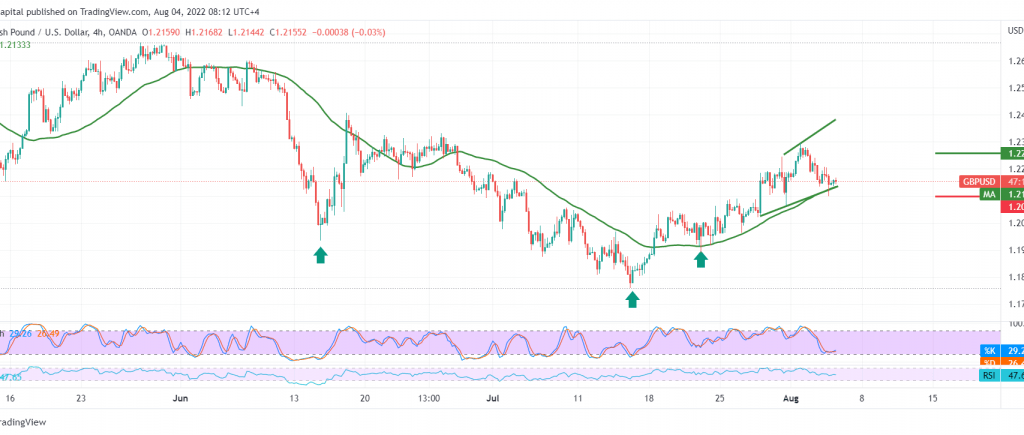

Trading tended to the negativity, which dominated the movements of the pound sterling against the US dollar. Still, it successfully retested the support floor published during the last report, at 1.2120, to witness the stability of the current movement above the mentioned level.

On the technical side, the pair is stable above the 50-day simple moving average, which is still trying to support the bullish daily curve, in addition to the momentum indicator receiving positive signs on the 240-minute time frame.

We tend to be positive, but cautiously, relying on the stability of trading above 1.2100, knowing that consolidation above 1.2170 is a motivating factor that may enhance the chances of rising towards 1.2210 and 1.2250 as long as the price is above 1.2100.

The return of stability below 1.2100 puts the pound under strong negative pressure, with initial targets starting at 1.2060/1.2050, and the negativity may extend later to visit 1.2000.

Note: High-impact economic data from the British economy is due today; interest rate decision, Governor of the Bank of England’s speech and the monetary policy statment issued by the Bank of England and the monetary policy summary, and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations