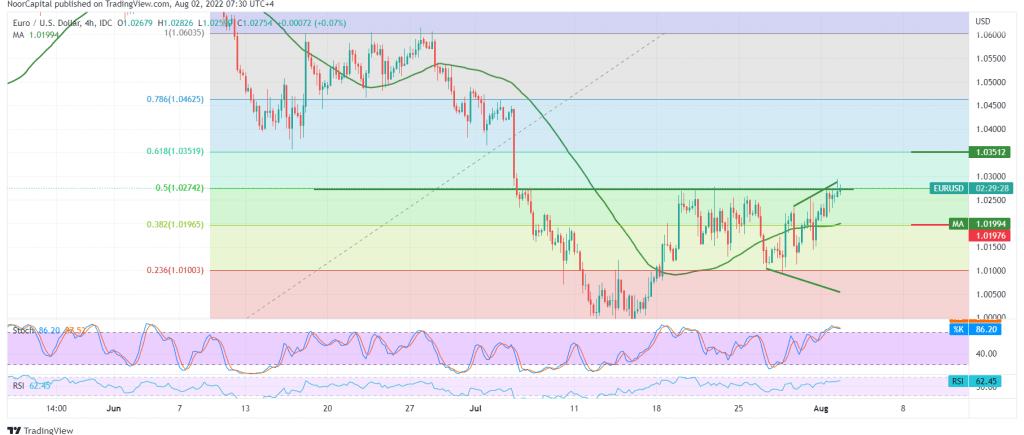

Quiet trading tilted to the positive, dominating the euro’s movements against the US dollar within the expected bullish path during the previous report, touching the first awaited target at 1.0275, recording the highest level at 1.0293.

On the technical side, today, we find the bullish scenario still valid, relying on the stability of trading above the support level of the psychological barrier 1.0200, as the pair getting positive stimulus from the simple moving averages that support the bullish bias, in addition to the stability of the 14-day momentum indicator above the mid-line 50.

The pair needs to hold above 1.0275, represented by the 50.0% Fibonacci correction, to facilitate completing the bullish bias to visit 1.0300 and then 1.0330 as a second target. After that, the gains may extend towards 1.0350, 61.80% correction.

The stability of daily trading above 1.0200 and most importantly, above 1.0160 are basic conditions to activate the bullish scenario, knowing that breaking 1.0160 puts the euro under negative pressure, and we are waiting for a retest of 1.0100.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0200 | R1: 1.0300 |

| S2: 1.0160 | R2: 1.0330 |

| S3: 1.0100 | R3: 1.0380 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations