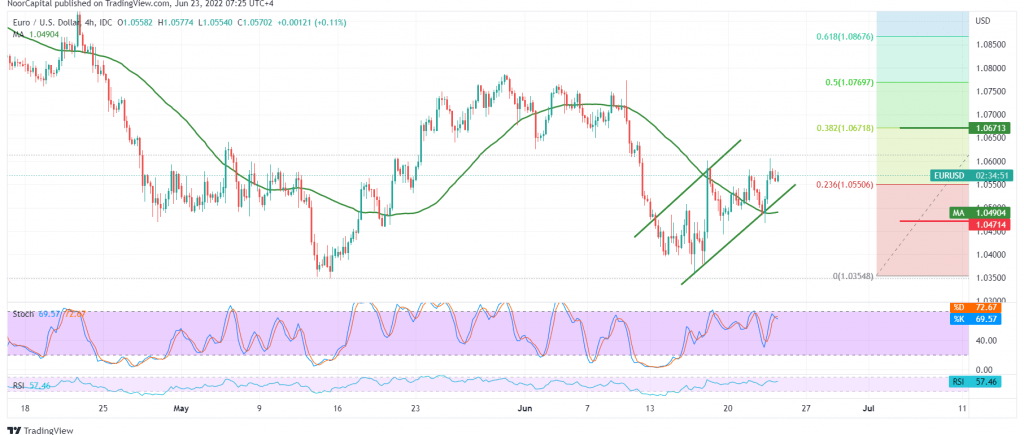

The strong support level published during the previous analysis at 1.0470 pushed the price to the upside, as we expected, for the euro to reach the required targets at 1.0550 and 1.0580, recording the highest around the psychological edge of 1.0605.

Technically, we find the intraday movements of the euro stable above the resistance level of 1.0550, as we find the 50-day simple moving average, which provides a positive motive, coinciding with the positive signs of the 14-day momentum indicator.

From here and steadily, intraday trading is above 1.0550 resistance, 23.60% Fibonacci correction, and in general above the pivotal support floor 1.0470; the bullish scenario remains the most preferred today, towards the third target of the previous report at 1.0630 and 1.0670, the next official station represented by the 38.20% correction.

The decline below 1.0470 will postpone the chances of rising and lead the pair to a bearish path. Its initial targets start at 1.0400/1.0410 and may extend later towards 1.0360.

Note: The testimony of “Jerome Powell” Chairman of the Federal Reserve is due today, and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0490 | R1: 1.0630 |

| S2: 1.0410 | R2: 1.0685 |

| S3: 1.0355 | R3: 1.0760 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations