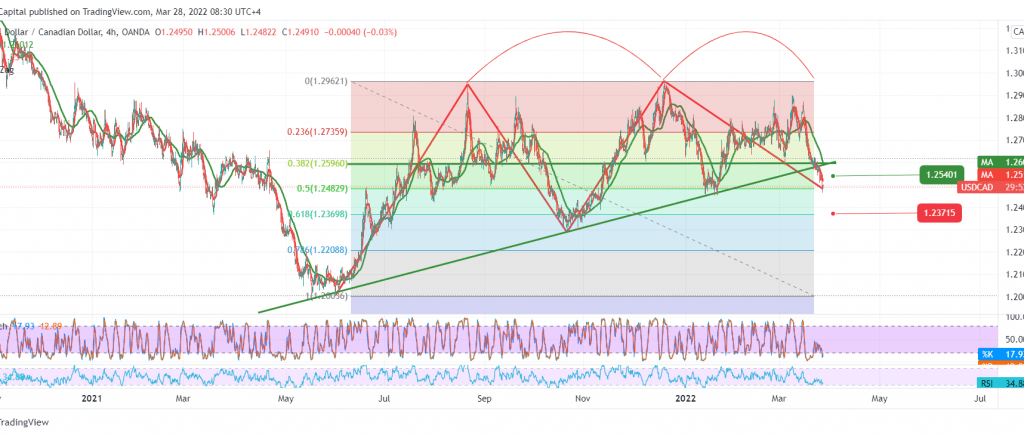

The Canadian dollar succeeded in touching the official price stop required during last Friday’s trading at 1.2480, recording its lowest level at 1.2465.

Technically, the pair is trying to build on the 1.2480 level represented by the 50.0% Fibonacci correction, as shown on the chart. We also noticed positive crossover signs that started appearing on the stochastic, trying to obtain positive momentum.

There may be a possibility of a bullish bias in the coming hours to retest 1.2540 first target, and its breach is a catalyst that helps touch 1.2590 as long as the price is stable above 1.2450.

The decline below 1.2450 leads the pair to the official descending path towards 1.2450 and 1.2370 61.80% correction of the awaited price stations. Note: the expected bullish limited slope does not contradict the general bearish trend.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.2450 | R1: 1.2540 |

| S2: 1.2400 | R2: 1.2590 |

| S3: 1.2365 | R3: 1.2630 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations