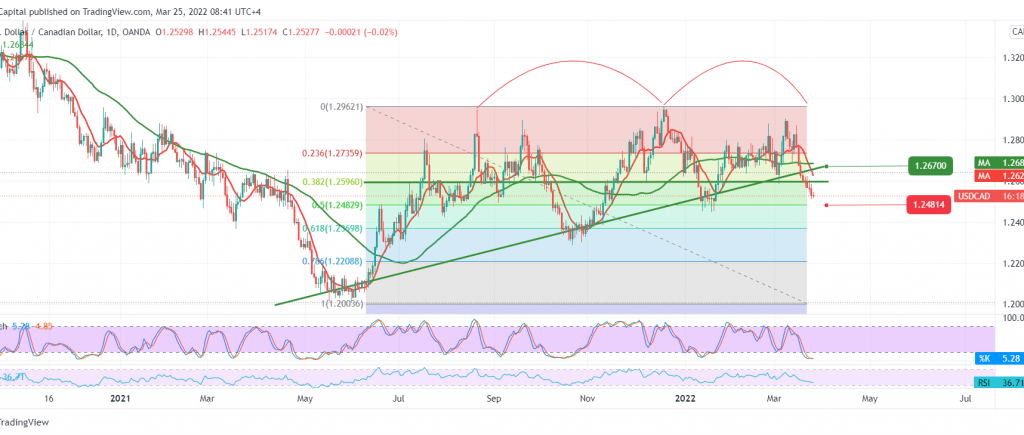

Noticeable negative trades dominated the movements of the Canadian dollar within the expected official bearish direction, explaining that trading below 1.2560 opens the way for the pair to visit 1.2480, to be satisfied with recording the lowest 1.2509.

From the angle of technical analysis today, and by looking at the 4-hour chart, we notice the pair confirmed breaking the 1.2560 support level. We also find the simple moving averages continuing to form negative pressure on the price.

Therefore, as shown on the chart, we maintain our negative expectations towards the official target 1.2480, 50.0% Fibonacci correction, as long as the pair keeps its stability below 1.2570.

Note: The risk level is high.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.2480 | R1: 1.2575 |

| S2: 1.2425 | R2: 1.2610 |

| S3: 1.2380 | R3: 1.2650 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations