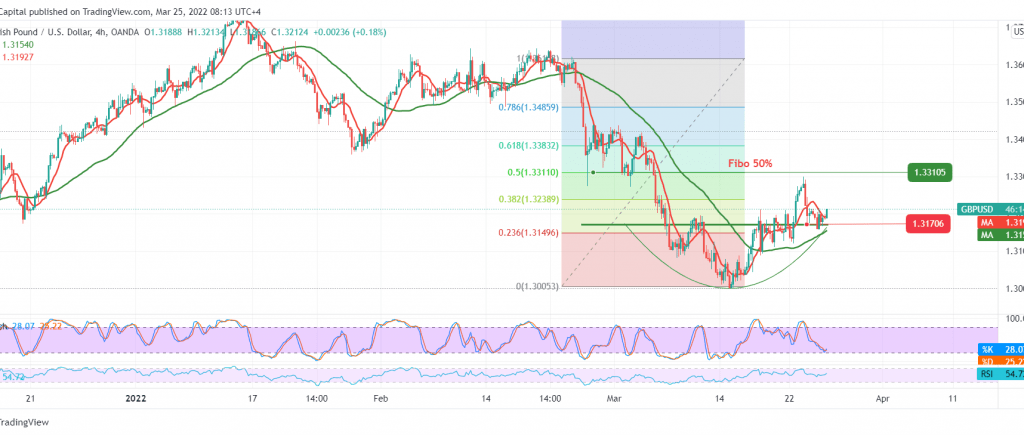

The support levels at 1.3170 were able to limit the slight bearish tendency witnessed by GBP/USD. The pair performs a typical retest of the required level and obtains an upward rebound to witness the stability of the current movement above 1.3200.

Technically and carefully considering the 4-hour chart, we notice that the pair continues to obtain positive motive from the 50-day moving average, accompanied by the momentum indicator obtaining positive signals and the bullish technical structure shown on the chart.

The possibility of ascending may be valid to visit 1.3240, 38.20% correction, knowing that its breach is a motivating factor that may enhance the chances of a rise towards 1.3280. The gains may extend later towards 1.3310, a profit-taking point around the 50.0% correction.

Trading and the pair’s price stability below 1.3170 may put the pair under negative pressure targeting 1.3110/1.3100 initially.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.3170 | R1: 1.3240 |

| S2: 1.3110 | R2: 1.3280 |

| S3: 1.3065 | R3: 1.3310 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations