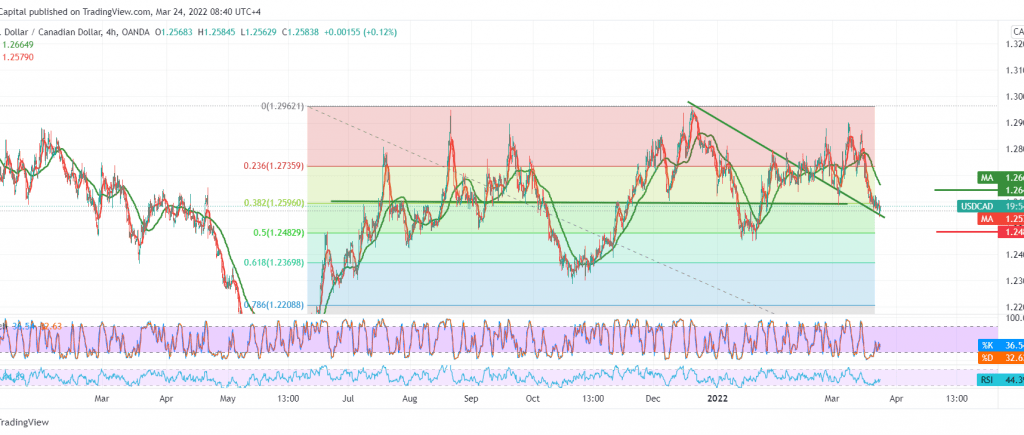

As was expected during the previous analysis, the Canadian dollar touched the first bearish target at 1.2560, recording the lowest price at 1.2542.

Technically, the pair’s current moves are witnessing bullish rebound attempts, benefiting from the intraday stability above 1.2560, accompanied by clear positive signs on the 14-day momentum indicator on the short time frames.

Therefore, the idea of a temporary bullish bias in the coming hours may be valid to retest 1.2640, knowing that its breach may be a catalyst for a visit of 1.2670. the general trend is still bearish, and breaking 1.2560 will extend the losses to be the next stop at 1.2480, 50.0% correction.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.2550 | R1: 1.2640 |

| S2: 1.2510 | R2: 1.2670 |

| S3: 1.2480 | R3: 1.2700 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations