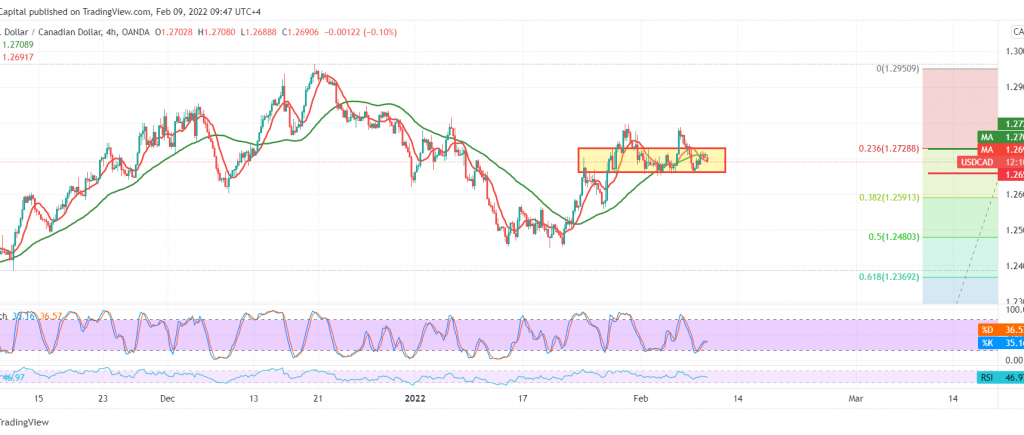

Sideways movements that tend to be negative tend to dominate the Canadian dollar for the second consecutive session. The pair’s movements are between the support level of 1.2665 and below the strong resistance level of 1.2720.

Technically, the simple moving averages continue to form a negative obstacle on the pair from above, in addition to stabilizing trading below the strong resistance level around 1.2730, the 23.60% Fibonacci retracement as shown on the graph.

On the other hand, we notice that the pair is still consolidating above the pivotal support floor 1.2665, which may lead to a bullish rebound once again.

We will monitor the pair’s price behavior during today’s session, noting that the decline below 1.2665 constitutes a negative pressure factor that might lead the Canadian dollar to visit 1.2595/1.2600 areas. At the same time, a breach up to the 1.2730 resistance level is a motivating factor that might lead the pair to restore its ascending path towards 1.2810 & 1.2860.

| S1: 1.2665 | R1: 1.2750 |

| S2: 1.2595 | R2: 1.2810 |

| S3: 1.2540 | R3: 1.2860 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations