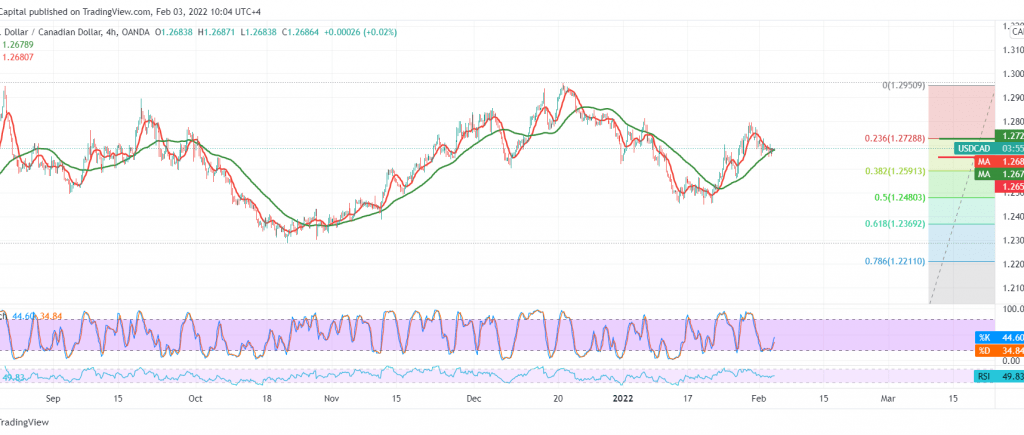

Narrow sideways trading dominates the movements of the Canadian dollar for the third consecutive session, between 1.2660 and 1.2700 without any change in the technical outlook.

Technically, and by looking at the 4-hour chart, we notice positive attempts that started appearing on stochastic to get more bullish momentum, in addition to stabilizing the price above the 50-day moving average.

We tend to resume the rise, but with caution towards 1.2730, considering that the breach of the mentioned level may enhance the pair’s gains towards 1.2820 and 1.2860.

Trading below 1.2665 may postpone the chances of rising, but it does not cancel it, and we may witness a slight bearish slope that aims to retest 1.2615 before attempts to rise again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.2665 | R1: 1.2760 |

| S2: 1.2625 | R2: 1.2820 |

| S3: 1.2570 | R3: 1.2860 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations