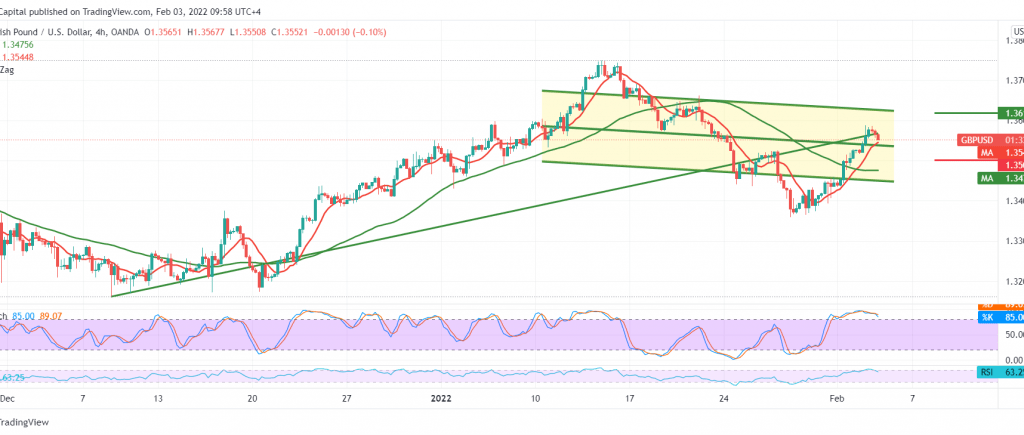

The British pound achieved remarkable progress against the US dollar within the expected bullish path mentioned in the previous report, touching the target price station at 1.3590.

On the technical side today, the intraday negativity features started dominating the stochastic indicator due to overbought. Therefore, there may be a possibility to retest the support level of the psychological barrier 1.3500 before attempts to rise again, knowing that the daily bullish path is headed to visit 1.3590 and 1.3620, respectively, unless we witness any Trade below 1.3500.

The decline below 1.3500 may postpone the chances of rising, and we witness a bearish bias to visit 1.3460, which may extend later towards 1.3420.

Note: ECB meeting and press conference is due today and may cause volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.3500 | R1: 1.3590 |

| S2: 1.3460 | R2: 1.3620 |

| S3: 1.3410 | R3: 1.3660 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations