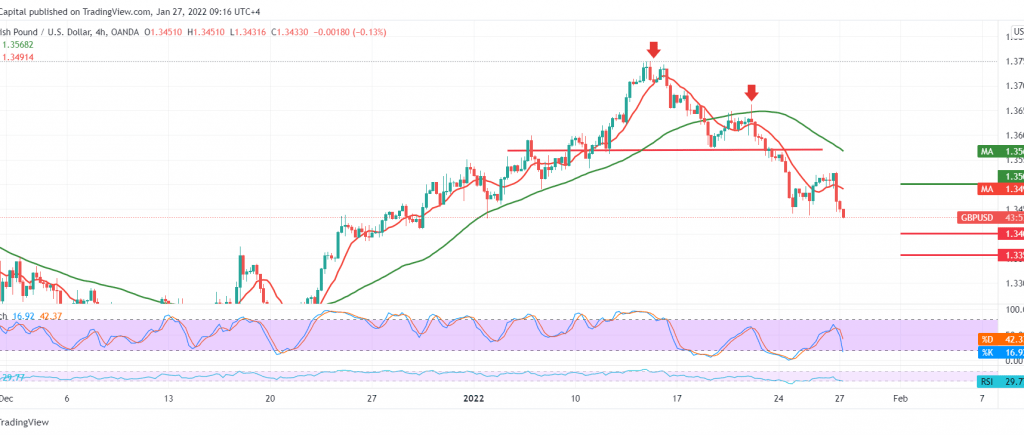

The negative moves continued to pressure the British pound against its American counterpart, within the expected bearish context during this week’s trading, within a gradual decline to the downside.

On the technical side today, the 50-day moving average is an obstacle limiting the upside, in addition to the continuation of the negative impact of the bearish technical structure shown on the 4-hour chart.

Therefore, the bearish scenario remains the most preferred today as long as trading is stable below 1.3500, knowing that the second official target of the bearish pattern at 1.3400 and breaking it will extend the losses of the pair, so we will be waiting for 1.33.70

Trading stability above 1.3500 can postpone the idea of descending, and we may witness an upward bias with an initial target of 1.3560.

Note: CFD trading involves risks; all scenarios may occur.

| S1: 1.3400 | R1: 1.3500 |

| S2: 1.3370 | R2: 1.3560 |

| S3: 1.3310 | R3: 1.3600 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations