Positive trades dominated the movements of US crude oil futures prices within the expected bullish context, during which we targeted 73.65, to be satisfied with recording the highest 73.30.

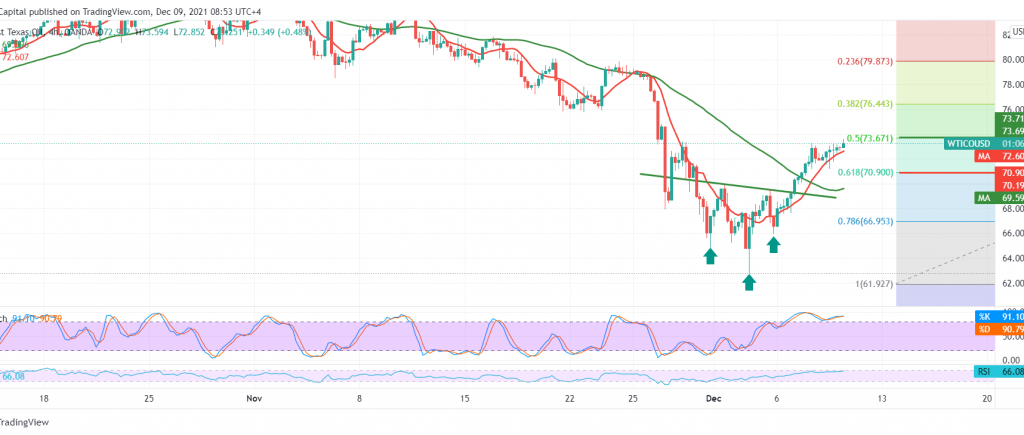

Technically, looking at the chart with a 60-minute interval, we find that the momentum indicator continues to provide stable positive signs above the mid-line, in addition to the positive motive coming from the 50-day moving average.

From here, and with the stability of the daily trading above the previously breached resistance level, which is now converted into a support level according to the concept of role exchange at 70.90 represented by the 61.80% Fibonacci correction, the bullish bias is the most likely, targeting 73.65 50.0% correction, taking into account that its breach increases and accelerates the strength The bullish bias opened the way to visit the price target 74.70.

From below, the return of stability below 70.90 is able to thwart the attempts to rise and put oil prices under negative pressure, with an initial target of 68.90.

Note: The risk level remains high.

| S1: 71.40 | R1: 73.65 |

| S2: 69.90 | R2: 74.70 |

| S3: 68.90 | R3: 76.10 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations