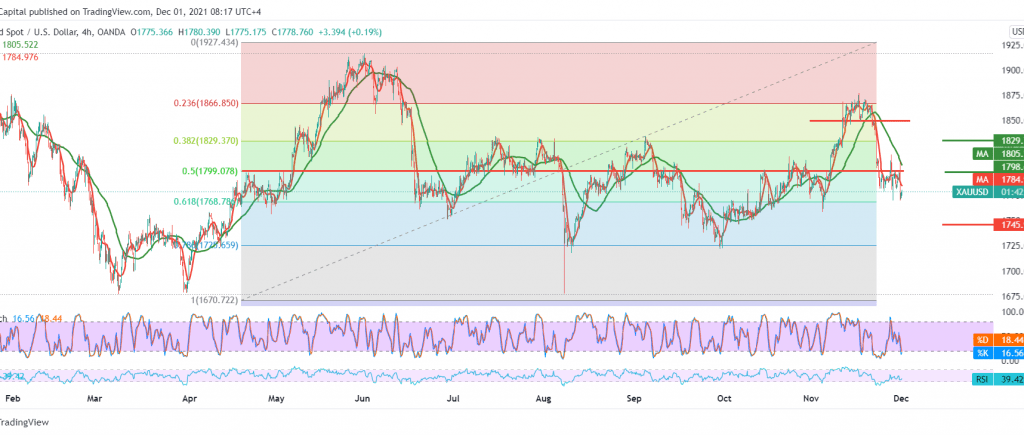

Mixed trades dominated gold prices during the previous trading session. As we mentioned, one of the primary keys for the trend is the resistance level of 1808, which forced the price to rebound to the downside and 1768 on the downside, which is trying to maintain positive stability.

The technical aspect today needs careful consideration and trading with caution, with the continuation of the clear negative pressure on the simple moving averages that pressure the price from above and the stochastic losing the bullish momentum gradually.

Therefore, with the price remaining below the 1799 pivotal supply area level represented by the 50.0% correction, the proactive path for gold today will be a bearish path, targeting 1768, 61.80% correction.

From above, the breach of 1800 and then 1808 can prevent the expected bearish scenario, and gold will recover towards 1823 and 1829 initially.

Note: The risk level is still high.

| S1: 1761.00 | R1: 1800.00 |

| S2: 1745.00 | R2: 1823.00 |

| S3: 1722.00 | R3: 1839.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations