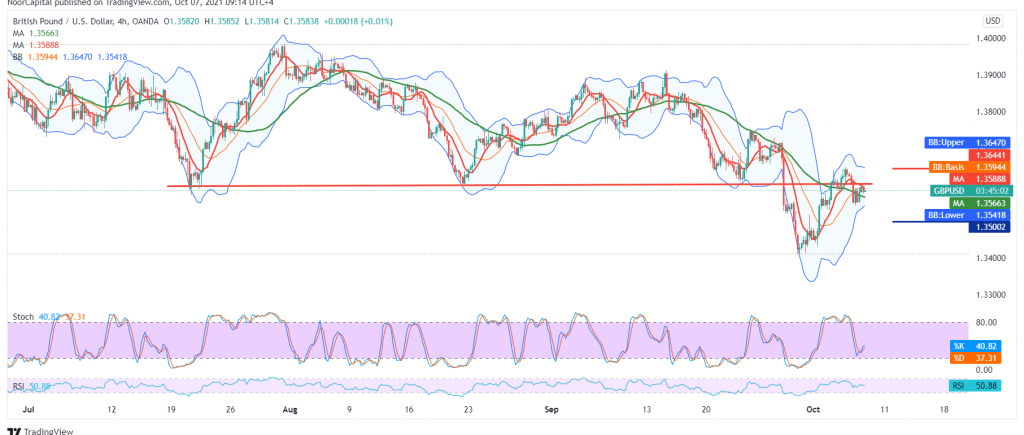

Narrow sideways trading dominates the movements of the pound sterling against the US dollar for the third consecutive session, confined between the support level of 1.3540 and the resistance level of 1.3640.

On the technical side today, and by looking at the 240-minute chart, we notice that Stochastic is losing bullish momentum, and we find that the RSI has started sending negative signals on the short time frames.

We believe that the bearish trend is still valid, targeting 1.3530. It should also be noted that breaking the mentioned level puts the pair under strong negative pressure, forcing it to head to 1.3480.

Rising above 1.3645 negates the suggested bearish scenario, we will witness ascending path whose initial target is around 1.3720/1.3695.

| S1: 1.3535 | R1: 1.3645 |

| S2: 1.3480 | R2: 1.3695 |

| S3: 1.3430 | R3: 1.3750 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations